Btrax Design Company > Freshtrax > Top 10 Mobile P...

Top 10 Mobile Payment Options in Japan

When was the last time you used cash? Thanks to Apple Pay, Google Pay, Paypal, Venmo and Facebook Messenger, etc., we have many cashless payment opportunities at retail stores, to split a bill with friends, or send money to family members in the modern society of the United States. But, how about in Japan?

[Related article] Japanese Hold As Many Credit Cards As Americans, But Do They Use Them?

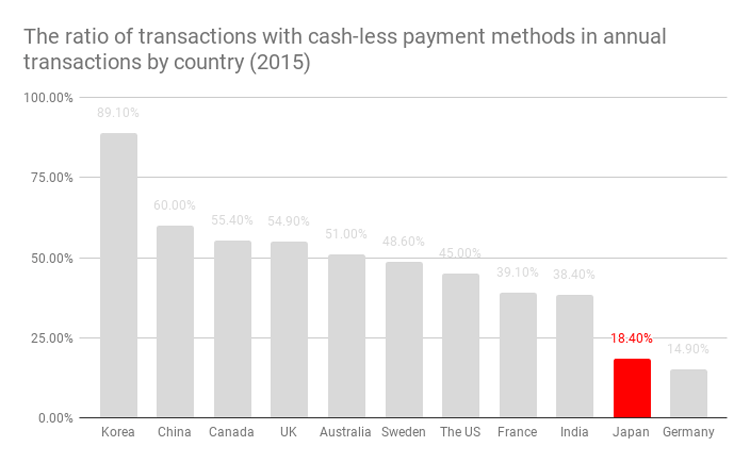

Japan is notorious for being a cash-based country. According to the Ministry of Economy, Trade, and Industry, only 18.4% of the household final consumption expenditure were paid via cashless payment methods, such as credit cards, electronic money, and mobile payments in 2015. This number is extremely low compared to other countries. (See the chart below)

However, the situation has drastically changed because of the rise of new mobile payment solutions. Let’s take a look at the mobile payment landscape in Japan and the key players that are changing Japan’s obsolete mobile payment system.

Japan’s Mobile Payment Landscape in 2019

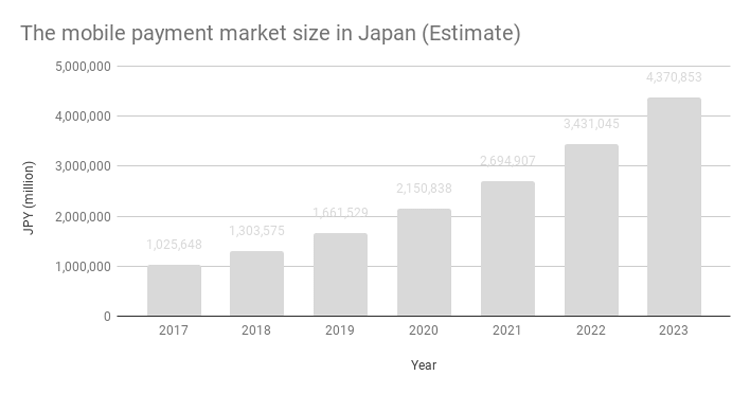

According to Yano Research Institute Ltd., the mobile payment market size in Japan is expected to increase from 8 million USD in 2017 to 48 million USD by 2023 (at the rate of 100 JPY = $ 0.8951 USD).

Please note that these numbers above are the total market size of both NFC based solution and QR based solution. We don’t dig into the technology of the mobile payment in this article, but I would like to share very basic technologies that enable mobile payment solutions so that we are all on the same page. As you may already know, there are 2 major different types of mobile payment technology; NFC and QR code. Most of the mobile payment systems are powered by either technology.

- NFC (Near-Field Communication)

Tap or hover your device on the NFC-enabled reader to make a payment.

(e.g. Apple Pay, Google Pay)

- QR code

Scan the QR code displayed by a merchant with your smartphone or the merchant scans the QR code displayed on your smartphone.

(e.g. Alipay, WeChat Pay)

Most Popular Mobile Payment Services in Japan

- PayPay

- LINE Pay

- Rakuten Pay (楽天ペイ)

- Origami Pay

- D-barai (D払い)

- merPay

- Pixiv PAY

- pring

- Apple Pay

- Google Pay

PayPay

Release: October 2018

Technology: QR Code

Image credit: PayPay

PayPay is operated by PayPay Corporation, the joint venture of Softbank and Yahoo!Japan. Though this is one of the newest mobile payment services, its brand awareness is very high because of the generous reward promotion campaign it conducted in December 2018. (We will cover this promotion in the next article, “Mobile Payment in Japan 2019: A Growing Market with Major Challenges”) To use it, you need to connect your PayPay account with your bank account or Yahoo! Wallet accounts. This app also allows you to send money to your friends and family. PayPay is currently only available at brick and mortar stores, but it is working to grow their retail partnerships. (As of April 2019)

LINE Pay

Release: December 2014

Technology: QR Code

Image credit: LINE Pay

Line Pay is one of the services provided by messaging app giant, LINE. The app has 79 million users in Japan and 194 million users globally. You can add balance to your LINE Pay account through your bank account or at convenience stores. It also offers an auto-charge function for more convenience. You can use LINE Pay not only at brick and mortar stores but also at online stores. LINE Pay provides secure and trustworthy service through its compliance with PCI DSS and ISO/IEC 27001 standards, the International standard for information security management system.

Rakuten Pay (楽天ペイ)

Release: October 2016

Technology: QR Code

Image credit: Rakuten Pay

Rakuten Pay is a payment service offered by Rakuten, one of the largest e-commerce platforms in Japan. You need to sync Rakuten Pay to your credit card. The benefits of using Rakuten Pay is you can earn Rakuten reward points which can be used in shops. Moreover, if you have a Rakuten credit card, you can earn double rewards points. You can use Rakuten Pay at both online and offline retailers.

Origami Pay

Release: 2015

Technology: QR Code

Image credit: Origami

Origami is the Japanese leading mobile payment startup company based in Tokyo. Many retailers offer a discount through Origami. Currently, Origami is available at more than 1.45 million partner stores in Japan and more than 1,000 partner stores globally. You can discover its partner stores on the map in the Origami app.

D-barai (D払い)

Release: April 2018

Technology: QR Code

Image credit: docomo

D-barai is a mobile payment service offered by Japan’s major mobile phone operator, NTT DoCoMo (“Barai” mean payment in Japanese.) This payment solution allows DoCoMo users to pay for their monthly phone bills. Since users are already registered with a Docomo account, they don’t need to connect their bank account or credit cards. You can earn reward points that can be used for online and offline shopping along with phone bill payments.

merPay

Release: February 2019

Technology: NFC/QR Code

Image credit: merPay

merPay is mobile payment service provided by Japan’s dominant second-hand online marketplace, mercari. You can add to merPay account by linking your bank account or use your earnings from your sales on the mercari marketplace. Thanks to mercari’s huge user base and high brand awareness, merPay acquired 1 million users in only 63 days! merPay can be used at more than 900,000 partner stores in Japan.

Pixiv PAY

Release: August 2017

Technology: QR Code

Image credit: pixiv PAY

Pixiv is a Japanese online community for artists and as its name shows, Pixiv PAY is a mobile payment solution provided by Pivix. To use Pixiv PAY, you need a Pixiv account. Because of the unique user demographics of Pixiv (mainly anime and manga fans), Pixiv PAY has started to prevail among Comic Market (Comiket) attendees, one of Japan’s biggest comic-related events. Comiket is known for cash-only and no-change transactions because most of the exhibitors are amateur creators. However, Pixiv PAY is changing this process at Comiket by offering an easy and convenient alternative payment solution for both exhibits and buyers.

pring

Release: March 2018

Technology: QR Code

Image credit: pring

pring started as a peer to peer mobile fund transfer service. We can call it the Japanese version of Venmo. You need to connect your bank account with the pring to use the service. pring puts its focus on facilitating communication among friends and family with the chat function. pring can be used for payment at retail stores, but as of today the options are very limited.

Apple Pay

Release: October 2016

Technology: NFC

Image credit: Apple

Needless to say, Apple Pay is Apple’s mobile payment service. The biggest difference from the aforementioned services is the technology that enables the payment solution. Since Apply Pay is powered by NFC, you can use some of the major E-money smart cards like Suica, QUICPay and iD. The ability to use E-money smart cards is particularly important in the Japanese market because Japanese people use E-money smart cards on a daily basis for commuting and small payments at convenience stores. (We will discuss this more later in this article.)

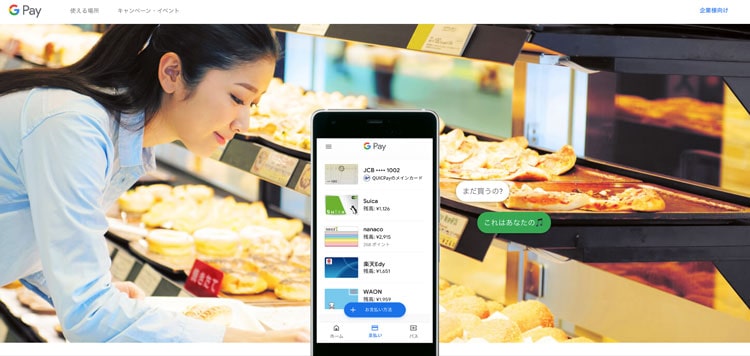

Google Pay

Release: Feb 2018 (Formerly launched as Android Pay in December 2016)

Technology: NFC

Image credit: Google

I assume you are also familiar with Google Pay. Google Pay is the Android‘s version of Apple Pay, which is also powered by NFC. While Apple Pay has a limited selection of available E-money accounts, Google Pays allows users to use 5 major E-money accounts: Suica, QUICPay, Rakuten Edy, nanako, and WAON.

Bonus: Too Many Incompatible E-money Smart Cards

In Japan, E-money smart cards powered by NFC technology are widely prevalent. According to the Statistics Bureau, Ministry of Internal Affairs and Communication of Japan, 56.3% of Japanese households own E-money smart card(s). E-money smart cards are categorized into 2 types: Prepaid fare card and prepaid shopping card. Fare cards, like Suica and PASMO, can be used for public transportation as well as for shopping. On the other hand, shopping cards like nanako, Rakuten Edy, and WAON only lets users shop at partner retail shops, but allows users to earn reward points.

Automatic ticket gate accepts e-smart money card in Japan.

The interesting part about Japanese E-money smart cards is that many business organizations create their own E-money smart cards. Unfortunately, they are not compatible with each other, so users have to carry multiple cards.

Takeaways

All of the aforementioned mobile payment options were launched in the last 5 years with more new services coming. As many of these mobile payment systems were launched in 2018, there is high growth potential in this market. In the next article, “Mobile Payment in Japan 2019: A Growing Market with Major Challenges”, we will discuss opportunities and challenges in the mobile payment market in Japan.

Love our articles? Sign up for our newsletter and follow us on Twitter so that you won’t miss our new articles! (Don’t worry, we won’t spam you. We only send a monthly newsletter filled with insights for business in Japan.)

Edit by: Julie Saephan