Btrax Design Company > Freshtrax > Localizing a Gl...

Localizing a Global Fashion & E-Commerce Company for Japan – The ShopStyle Interview

The e-commerce and retail space has undergone many changes due to technological advancements and evolving consumer habits in the last decade. As a result, ShopStyle – a popular search and shopping platform – has had to adapt to that while also keenly aware of the cultural differences between the countries they operate in.

So far, Japan is the only country not in North America or Europe (or Australia) that ShopStyle is active in – so it is an especially interesting and unique market for them.

Founded in 2007, ShopStyle entered the Japan market in 2010. Japan is a major market for fashion and e-commerce, so it’s no surprise that a company that combines those two elements would choose to enter the Japan market in its third year of business.

I had the chance to have a conversation with Hibaru Maywood, Country Manager of the Japanese site for ShopStyle.

In this interview, Hibaru talks about ShopStyle’s strategy in Japan, the challenges they currently face, and gives tips to foreign companies eyeing the Japan market. Check out our conversation below!

ShopStyle was founded in 2007 and decided to go to Japan in 2010. What was it that made them decide to do that, and based on what?

Hibaru: ShopStyle launched first in the United States, and then in the UK, France and Germany. After that, they were looking for their next move – Asia. Knowing that Japan has a huge influence on fashion and trends in Asia and throughout the world, they decided to launch in Japan.

While there are many western brands on our site, 62 percent of the brands on ShopStyle Japan are actually domestic Japanese brands.

Coincidentally, many western brands – such as Forever 21, H&M, and Abercrombie & Fitch – entered the Japan market in the same year. Together these brands created excitement around western fashion brands in Japan.

Are there any UX/UI differences between the US and Japan site for ShopStyle?

Hibaru: We don’t have any major UX or UI differences between the US, Japan, or other markets’ sites. But while there are many western brands on our site, 62 percent of the brands on ShopStyle Japan are actually domestic Japanese brands. The content is different.

What is your main target audience? Do they generally prefer western brands?

Hibaru: In terms of our target user, the general age range is from 25 to 40 years old. It’s a very wide range, but conservative brands are popular here – the brands that sell clothes that women and men can wear to work. Some brands make an effort to reflect that in their merchandising, and we do that as well. For example, when selecting our front page features for ShopStyle Japan, whether it’s a pair of shoes or a celebrity’s outfit, we try to pick more conservative styles that people can wear to work.

When we first launched ShopStyle Japan, our business focused on building good relationships with domestic brands and retailers. Because Japanese people liked to shop at trusted domestic retailers, we displayed mostly domestic brand products on our site. But in the last few years, many western brands launched Japanese language e-commerce sites.

Most of our Japanese users are typing and searching using Japanese, so brands that don’t have a localized Japanese site may not be discovered as easily by Japanese users.

So now we are building relationships with them and have gained a lot more western brand partners for ShopStyle Japan. But in terms of our users, they’re coming to ShopStyle by searching different brands and trend keywords as well. For example, off-the-shoulder tops are popular this season all over the world, and Japanese users are also interested in that trend.

In general, our branding is global and our users mostly like shopping international brands as well.

Interviewer: For brands to be featured or searchable on ShopStyle, they have to have the ability to ship products to Japanese consumers. So on ShopStyle Japan, you can only find western brands that are also shipping to Japanese consumers from their flagship sites. Is that correct?

Hibaru: Yes, exactly. We have two types of western brand stores on our site. The first is, as you mentioned, their flagship site, not necessarily localized in Japanese, but they ship to Japan. But most of our Japanese users are typing and searching using Japanese, so brands that don’t have a localized Japanese site may not be discovered as easily by Japanese users.

Japanese people loved high-end luxury brands, but they were not used to buying expensive products online yet. So the Japan site initially focused on more mass market and domestic brands.

The second type of store is the localized Japanese site. We aggregate their product information, which is in Japanese, which means Japanese users can search their products on ShopStyle the same way they do domestic brands. This is a much better user experience and is more profitable for everyone.

ShopStyle entered the Japan market in 2010. What was the initial strategy and how has that changed since the first year?

Hibaru: When we first launched ShopStyle Japan in 2010, our US site was pretty different from the current version. Of course, this wasn’t just for Japan, but all sites have changed a lot since then. We had a horizontal scroll instead of a traditional vertical scroll. This was a really unique user experience that recreated the effect of reading a magazine on your browser.

In the US, consumers were more accustomed to buying luxury brands online and our site reflected the high-end user base with our range of high end stores, from Neiman Marcus to Saks Fifth Avenue to Net-A-Porter. While Japanese people also loved high-end international luxury brands, they were not used to buying expensive products online yet. So the Japan site focused initially on more mass market and domestic brands.

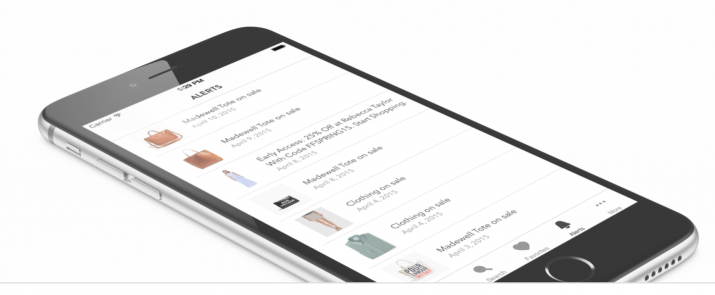

As for our unique horizontal browsing experience, this worked in 2010 because virtually all users browsed and shopped on desktop. But since then, smartphones have become more popular, and when browsing on mobile, the horizontal scrolling user experience doesn’t work anymore.

In Japan, 60 percent of our sales revenue comes from mobile.

To adapt to this, we updated our UX to the current version, where users scroll vertically instead of horizontally. The shift to mobile is the biggest in terms of changes to the ShopStyle business in the last few years. Also, at the time, we focused on more domestic and mass market brands, but now, as Japanese users are buying more global brands online, we’ve opened up to partner with more global brands, too.

Interviewer: In the last six years, smartphone penetration in Japan has increased exponentially. How has the mass adoption of smartphones affected ShopStyle’s strategy beyond basic website UX changes like removing the horizontal scrolling?

Hibaru: Besides changing the UX of our website, we are now also more focused on mobile development. We are trying to capture more users for our app and mobile web, and we’re constantly improving our UI and adding more features. Japan is one of the most successful markets for us in terms of mobile. Other markets have very low conversion rates on mobile devices, but in Japan, 60 percent of our sales revenue comes from mobile.

Our big challenge is figuring out how to get users to purchase luxury brand goods on mobile.

Interviewer: Why do you think that is?

Hibaru: Even before smartphones became popular, Japanese people were already used to shopping on their phones because Japanese feature phones had e-commerce capabilities. Also, many Japanese stores and brands got a head start in optimizing for the smartphone.

As the number of mobile users increased, our mobile conversion also increased. But recently, we’ve actually been seeing the average order value fall because users are still hesitant to purchase high priced luxury brands online via their smartphone. Our big challenge is figuring out how to get users to purchase luxury brand goods on mobile, like they do on desktop.

Interviewer: By average order value, do you mean that in Japan, the purchase value per person is decreasing?

Hibaru: Yes, because people are shifting their buying from desktop to mobile, but buying lower-priced products. I think people are more comfortable buying luxury products on desktop because they can see more details – larger images, detailed shipping methods or return policies. But on mobile, that’s still a little bit hard.

Who were ShopStyle’s key competitors in 2010, and how has that changed today?

Hibaru: ShopStyle in 2010 was perceived to be either an American retailer (like Forever 21 or Gilt) or more like an outfit collage app, similar to Polyvore. Polyvore was not in Japan at the time, so we didn’t see them as a competitor. There was a Polyvore-like service in Japan that launched at a similar time called iQON. iQON changed their user experience a lot recently but they used to be an outfit collage site, and we were often compared to them.

Today, any product search website, online marketplace or fashion shopping mall may potentially be our competitor.

Recently we have focused more on smart and personalized search – as a fashion search engine. Today, any product search website, online marketplace or fashion shopping mall may potentially be our competitor. And especially in Japan, we’ve been promoting a more global brand image, so our users tend to have a more global background or are interested in western brands. Domestic shopping sites with global brands that target a similar audience in Japan could be considered our competitor.

Interviewer: What kind of global shopping sites are there?

Hibaru: There’s a site called Buyma that allows individual buyers who buy products overseas and to resell to Japanese consumers. Their focus is on enabling consumers to buy overseas products on a Japanese platform via these buyers. We focus on allowing consumers to buy directly from the source – the international online stores. However, I understand that some consumers hesitate to shop directly so our role is to educate consumers about the trusted international stores and brands.

Numbers-wise, how is ShopStyle doing in comparison to before, and how much has the platform grown compared to your competitors?

Hibaru: We grew a lot in the first five years, and currently have 700,000 unique users per month in Japan alone. Sales on mobile is now at 60 percent or more. This percentage is maybe two or three times more than that of our competitors.

What are some of the biggest challenges ShopStyle has faced expanding in Japan?

Hibaru: Our business model is based on affiliate marketing, so our retailers, brands and stores are paying us an affiliate fee based on how much users are purchasing through ShopStyle. There is still a conservative affiliate marketing culture in Japan compared to our other markets.

We would really like to further our partnerships with Japanese retailers and launch new features, but they are conservative about investing in third-party services like ShopStyle.

In other markets, retailers are spending a lot of money on affiliate marketing, but the Japanese fashion industry is conservative when it comes to affiliate or digital marketing and spending more on traditional advertising. Our challenge is to figure out how to help the affiliate marketing managers at domestic retailers and brands convince their managers and the executive teams at these organizations to move more budget to digital and affiliate marketing.

We would really like to further our partnerships with Japanese retailers and launch new features, but they are conservative about investing in third-party services like ShopStyle, so we in turn tend to be conservative about launching features in the Japan market.

For example, we have a great blogger program called ShopStyle Collective that is growing tremendously alongside the fashion blogger culture in the US and EU markets. There are many fashion bloggers in Japan as well, but launching a blogger program would mean retailers also need to be on board and be willing to spend money on this type of marketing.

Interviewer: Is a blogger program when retailers pay money if a blogger refers buyers through ShopStyle to their site and a purchase is made?

Hibaru: Yes. So through ShopStyle, we pay bloggers when they drive sales to retailers. We also bring together brands looking to do sponsored campaigns – like an ad campaign – with fashion bloggers. This business model has worked really well for us. We have so many connections with bloggers and retailers, so we are in a really good position to connect them.

Fashion blogger culture in Japan is different compared to that of the US or EU markets.

Interviewer: So the challenge of launching this in Japan is getting the brands to sign up for it?

Hibaru: Yes. Exactly.

Interviewer: What about on the blogger side?

Hibaru: The blogger side is a challenge as well. The fashion blogger culture in Japan is different compared to that of the US or EU markets. We are still figuring out how to communicate with bloggers and how to educate them about our programs. My hope is that we can launch the blogger program in the next couple of years.

What would be your advice to other internet retail companies interested in expanding to Japan?

Hibaru: I highly recommend hiring or partnering with someone who not only can speak, read and write the language, but also truly understands the culture and customs, because direct translation doesn’t work. When localizing, we need to pay attention to the culture, habits and customs of the people who live in that country as well.

For example – shopping habits in Japan are very different than what we are used to in the US. In Japan, people work in the office between 9:00AM to even 10:00PM on weekdays, so they don’t have time to shop on their computers. In the US, people might shop online during their lunch break at the office, but that’s not appropriate in Japan – people don’t sit in cubicles so they don’t have any privacy. This was eye opening to my American managers.

It’s not enough to just be able to speak and read Japanese, but you have to fully understand the Japanese experience as well.

I’m a little bit hesitant to say so myself, but for example, I’m a valuable person in helping to localize ShopStyle for the Japanese market because I’m actually from Japan. It’s not enough to just be able to speak and read Japanese, but you have to fully understand the Japanese experience as well.

Another example – if you ask a Japanese consumer if they’re signed up for your brand’s “email newsletter,” they won’t understand you. What we call “email newsletter” in the US is called “mail magazine.” These things are subtle but important to understand to succeed in marketing in Japan. Things like payment options and shipping methods need to be understood. Social media channels and their usage is very different from other markets, too.

[Related article: Japan’s Social Media Landscape in 2016]

It’s very important to partner with such a person or hire such a person in-house. Finally, partnering with ShopStyle could also be a good opportunity. We recently supported various brand launches in Japan.

The key is how to maintain the momentum of the business beyond the first couple of months – how to stay connected with Japanese consumers.

What are some of the social media channels used by online companies in Japan right now?

Hibaru: Facebook and Twitter is very commonly used, and Instagram is growing. Of course, there’s the LINE App. LINE is the most popular messaging app in Japan. People are constantly looking at LINE every day, so it is a really key social channel for companies and brands as well. Many companies are creating LINE accounts.

Interviewer: How would a company use LINE?

Hibaru: A company can open an official brand account and directly message users. For example, brands can send information on deals and links to coupons, or they can advertise limited time sales by messaging their customers on LINE.

Interviewer: So it’s not really a conversation, but more like a newsletter subscription.

Hibaru: Yes. It’s like a “mail magazine” or a push notification on the LINE app.

Do you think there’s room for more players similar to ShopStyle in Japan?

Hibaru: I definitely think there is room for more western brands and companies to expand their business to Japan. There are many western businesses, like food, fashion or Internet services launching in Japan right now, and overall, I think that Japanese people are excited to see these businesses come to Japan.

Also, Japanese consumers generally like to follow western trends, and the key is how to maintain the momentum of the business beyond the first couple of months – how to stay connected with Japanese consumers.

The key is to maintain the momentum of the business beyond the first couple of months and stay connected with Japanese consumers.