Btrax Design Company > Freshtrax > Understanding J...

Understanding Japanese Dating Culture

We can understand the Japanese dating scene by looking at Japanese dating culture, online and offline dating trends, and other factors, such as government initiatives and Japanese demographics.

In this article, we’ll help you understand the Japanese dating scene and share why the top 5 dating apps in Japan are successful.

Overview

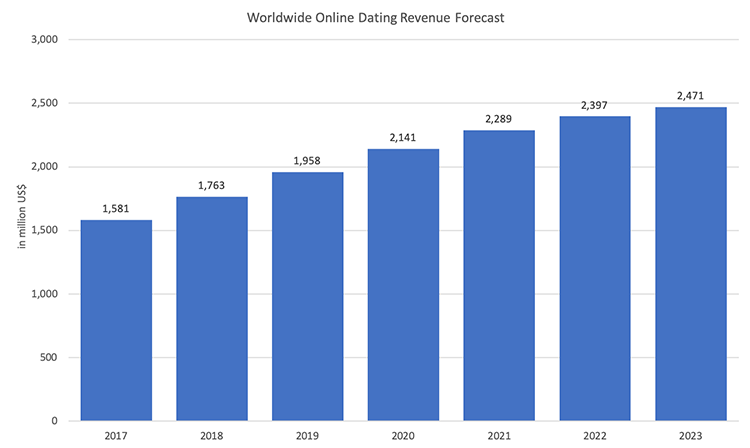

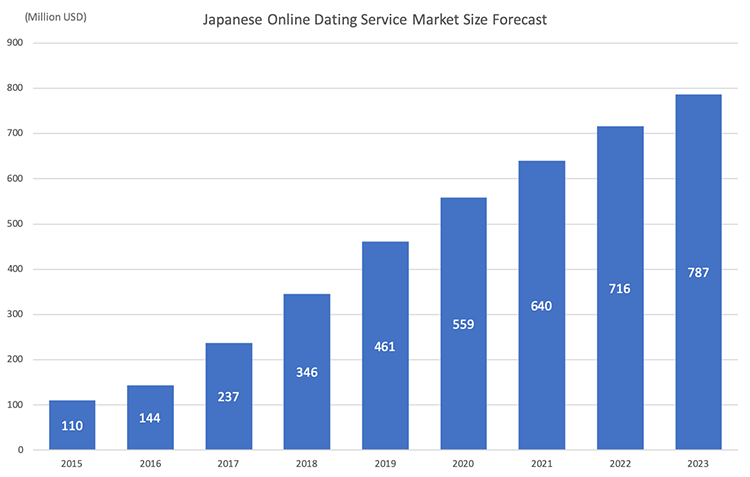

- The online dating market in Japan is expected to grow 3.32 times from 2017 to 2023 while the global online dating market is expected to grow 1.56 times over the same period.

- There has been a significant increase in the number of dating service users in Japan. In 2016, 15.6% of single individuals used dating services, while nearly one-fourth of single individuals (23.5%) used dating services last year.

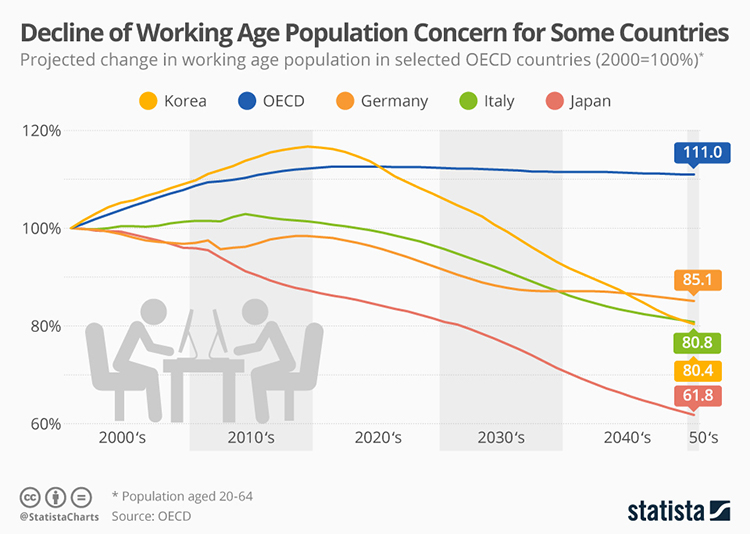

- Japan’s declining birth rate and aging population are leading to declines in population and working-age population, which are the worst rates in selected Organization for Economic Co-operation and Development (OECD) countries.

- To overcome the decline in the population, the Japanese government is encouraging people to marry by offering government-funded support like subsidies for low-income couples, hosting marriage hunting parties, and introducing matching agencies.

- The stigma Japanese people used to have against dating services has improved over the last decade, especially online dating.

- The top five dating apps in Japan are Pairs, tapple, Tinder, with, and Happy Mail.

The online dating industry has been growing everywhere in the world for quite some time. Highlighting this growth, Facebook entered the online dating market this past September with “Facebook Dating,” a platform it first announced in May 2018.

Nearly 50 million people in the United States, a country where 54.4 million people are single, have used dating apps. According to a study conducted by sociologists Michael Rosenfeld and Sonia Hausen of Stanford University and Reuben Thomas of the University of New Mexico, 39% of heterosexual couples in the US met online.

The projected growth of users who are willing to pay for online dating services in the countries listed in the Digital Market Outlook. (Source: Statista)

The projected growth of users who are willing to pay for online dating services in the countries listed in the Digital Market Outlook. (Source: Statista)

The online dating industry has been growing more than ever in Japan and is expected to continue growing. The Japanese online dating market is projected to triple from $237 million in 2017 to $787 million in 2023. Online dating is just one part of the broad dating industry in Japan that has taken off because of shifting cultural factors and public policy.

Let’s start by looking at the background of Japan’s dating industry.

Japanese dating culture and history

Declining birth rate and an aging population

Japan’s declining birth rate and aging population are issues that are currently being addressed.

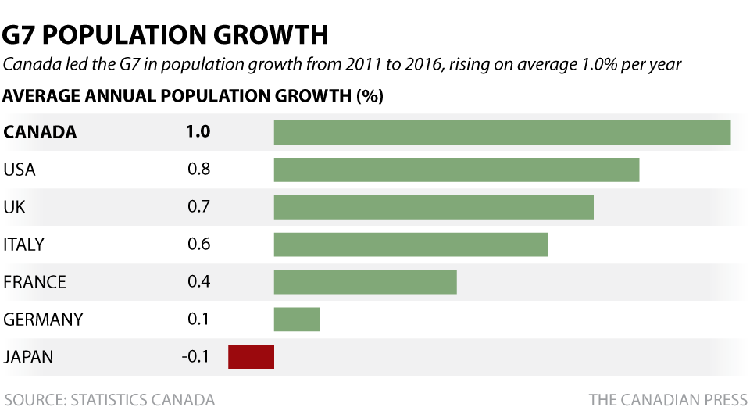

As you can see in the below graph, Japan has the lowest population growth in the Group of Seven (G7). It is actually the only one of the seven countries to be declining in population.

(Source: CTV News)

It has also been the most heavily affected by a decline of the working age population among OECD countries. Looking forward to 2050, Japan will have dramatically lowered the percentage of the population that will be working. In 2050, no other country on the graph will be anywhere near Japan in terms of the low percentage of working age population.

(Source: Statista)

Rise in late marriage

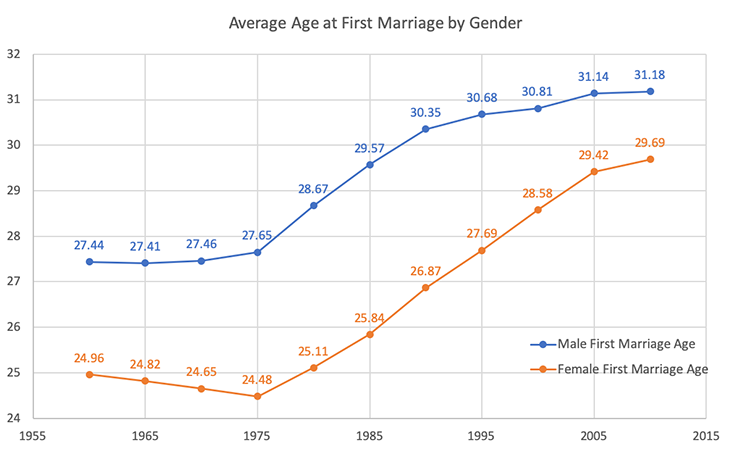

Late marriage has become a new normal in Japan. The average marriage age is around 30 years old, about two years older than in the US, and about four years older than Japan in 1975. Some of the reasons people ages 25 to 34 give for not getting married are: “not yet financially stable,” “can’t communicate well with the other sex,” and the biggest reason of all: “haven’t met the right one.”

(Source: Osan Kojyo (Childbirth Improvement) Committee)

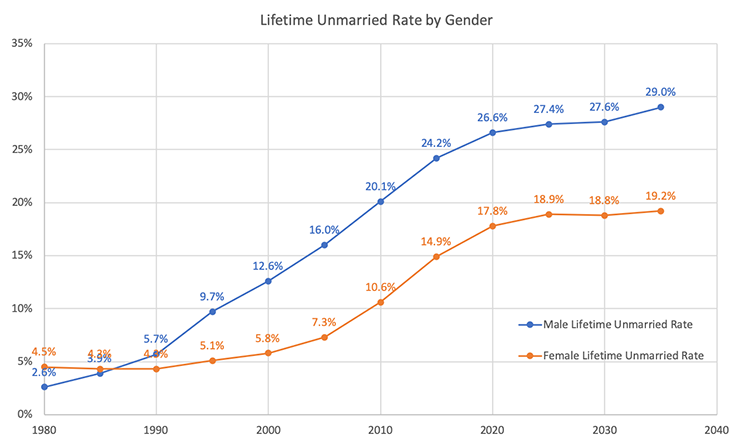

Increase in lifetime unmarried rate

The lifetime unmarried rate has dramatically increased in Japan over the last four decades. Although there are people who do not intend to marry, they comprise only about half of those who remain unmarried throughout their lives.

(Source: Kekkon Shitai)

Hookups or casual dating are strong taboos

Culturally, having sexual intercourse outside of an “official” relationship has been considered “filthy,” even among those who do not practice a religion (which is a major part of the entire population). When I was young, even kissing a girl was something you couldn’t do until you became boyfriend and girlfriend.

Many Japanese people think a “real relationship” only happens in the real world, not through meeting someone on the internet. Until around 2015, more than 72% of married couples met through work, mutual friends, family or school.

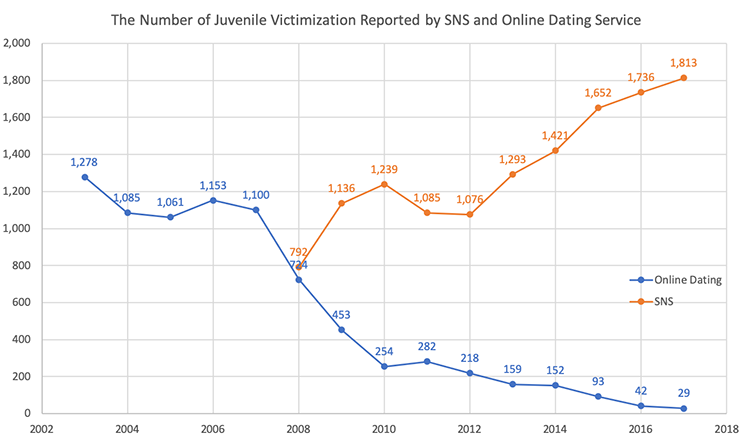

Meeting people online, especially through online dating services, was considered sketchy or even dangerous. Early online dating services were linked to crimes such as murders, fraud, kidnapping, and child prostitution. Most of the victims were female minors. Thankfully, the situation has improved a lot over the past decade as police departments have taken these crimes very seriously and worked to lower the number of incidents.

(Source: The Education Newspaper)

Japanese government gets involved: Grants for dating services

The declining birth rate, a decrease in the working-age population, and overall population decline finally prompted the Japanese government a few years ago to take political action and get involved in Japan’s dating crisis.

For example, one cabinet office started providing about $2,800 for newly married, low-income couples to support their married life. The government also provided grants to local governments that set up a local matching agency service or hosted marriage hunting meetups at local venues.

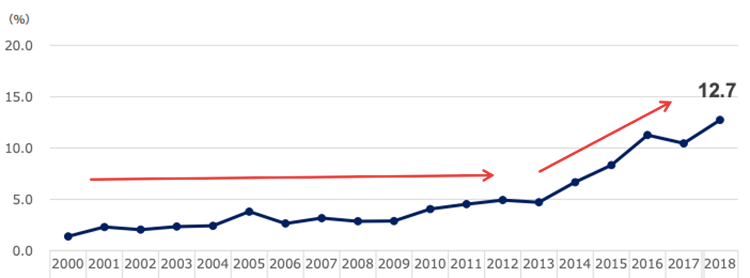

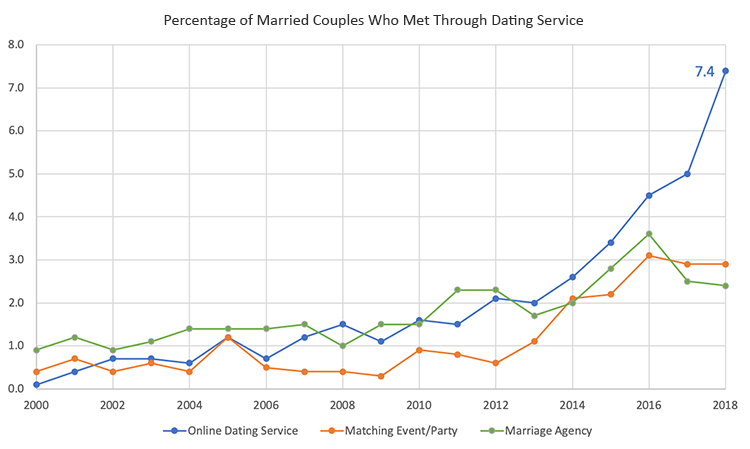

Some of these initiatives have been effective in increasing marriage and birth rates according to government data. This early success and continued government involvement loosened some of the cultural reluctance around dating services, which eventually led to an increase in dating service users. For instance, the proportion of married couples who met through dating services reached its highest levels last year.

Married couples who have met through dating services. (Source: Recruit, Bridal Research Group)

Online dating services are taking the lead in the dating industry

(Source: “Bridal Fact-Finding Investigation 2019” by Bridal Research Group)

The reduction in crime incidents from online dating platforms and the government’s support of dating services have helped to remove the stigma around both online and offline dating services. As a result, the number of users is increasing steadily. Last year, about one-fourth of single individuals used dating services and 16.5% used an online dating service.

The online dating industry has been growing significantly since 2015 and is expected to continue expanding in market size.

(Source: Cyber Agent)

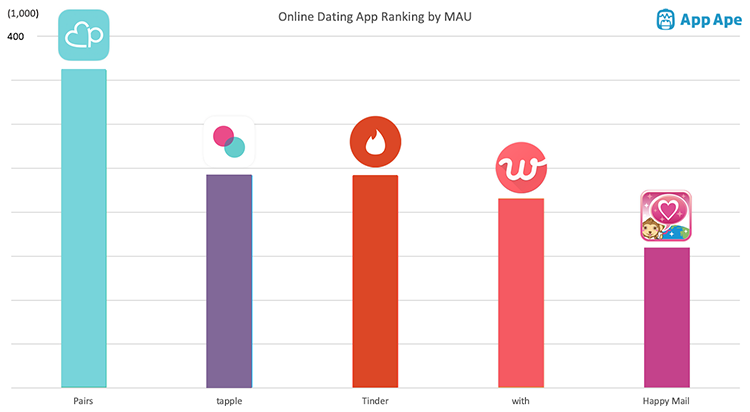

Now, let’s look at the most popular online dating apps in Japan by monthly active users (MAU) and user demographics to see some features of online dating apps in Japan.

5 most popular online dating apps in Japan

Here are the 5 most popular online dating apps in Japan. Pairs is first followed by tapple, Tinder, with, and Happy Mail.

All values are estimates. (Source: App Ape)

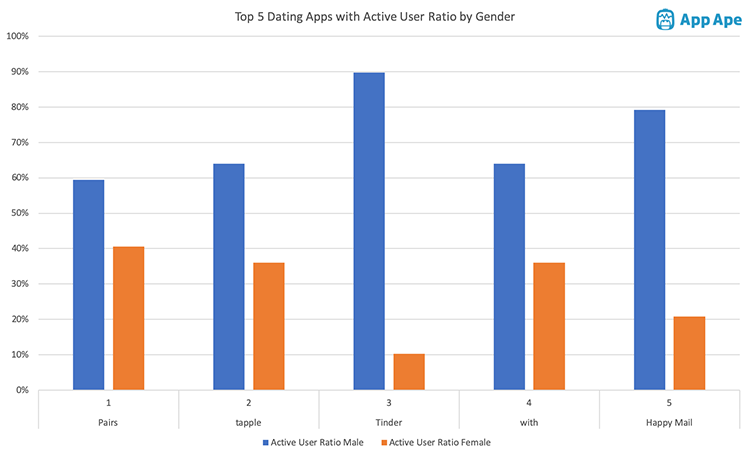

In the graph below, you can see the gender ratios of each app.

All values are estimates. (Source: App Ape)

1. Pairs

Pairs is the most popular dating app in Japan. It surpasses its competitors in accounts (active and inactive) and MAU.

More impressively, it has a more balanced ratio of active male and female users than any other Japanese dating app with 60% of male users and 40% of female users. Most users are in their 20s and 30s. 50% of those users are male and 36.7% are female.

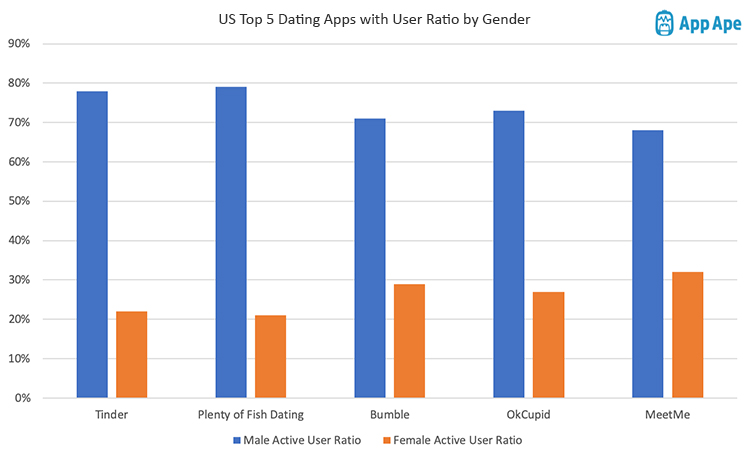

Pairs even outperforms the leading dating apps in the US when comparing user ratio. Looking at the top 5 most popular dating apps in the US, the active user ratio is heavily skewed towards male users. As you can see in the graph below, males comprise about 70% or more of the active users count for most dating apps in the US.

All values are estimates. (Source: App Ape)

Pairs has continued to acquire users. It had over 100 million subscribers in January 2019. It intends to enhance branding and user experience by focusing on UI and data manipulation.

Pairs also integrated Facebook user verification into its app which has helped to eliminate females users’ fear of using online dating apps. It has also created more than 1,000 communities on Facebook based on different activities. The goal of these communities is to help people find other singles who are interested in the same activities and foster more serious relationships.

Similar to Pairs, “tapple” and “with” also have a better balance of active users by gender compared to other similar apps.

2. tapple

tapple’s active user ratio between males and females suggests that tapple is used more for casual dating in comparison to Pairs since female users are looking to “serious date” and tend to shy away from “casual dating” apps.

tapple is popular because of a few key features such as the ability to search for dates based on hobbies or time and date availability, and built-in functions to plan dates easily, such as making a restaurant reservation within the app and receive a discount. These features give users the “push” to hop on a date.

3. Tinder

Tinder is one of the most popular dating apps in Japan and the only one on the list that wasn’t created in Japan. Although Tinder tried to differentiate itself from its competitors in Japan by branding itself as an “English learning matching app,” it is still considered a “hookup app,” similarly to how it appears to be perceived everywhere else.

Japanese users, especially female users, want to look for more serious relationships on dating apps. Tinder’s fundamental swiping system inevitably drives its users to judge a person by their looks, which doesn’t promote good personality matches.

4. with

with is another popular Japanese dating app. It is overseen by a very famous Japanese mentalist, DaiGo. The app conducts a personality test and compatibility diagnosis and uses Daigo’s psychological analysis to create matches. This unique feature creates an effective matching process and provides a high success rate of matching according to user reviews.

5. Happy Mail

Happy Mail is the oldest online dating service among these five dating apps. The service started in 2001, when it was originally just a website.

Since the stigma of online dating existed strongly back then, this service was used for casual dating or looking for a “sugar daddy.” According to reviews, the app still has a large segment of users looking for a sugar daddy, a sugar baby or just hookups. So even though it has the fifth most MAU, its reputation remains lower than the other apps.

Why the localization of dating apps in Japan is important

Make sure to properly localize your online dating app as the user experience really does need to be tailored to Japanese users.

As we mentioned before, Pairs has worked to enhance user trust by employing Facebook user verification to eliminate female users’ fear of using online dating apps. Also, with the thousands of activity-based communities it has created, it integrates social networking features to connect people around similar interests and encourage more serious relationships through more than just physical attraction.

tapple provides an experience where users get support in planning dates through restaurant reservation capabilities on the app and restaurant discounts that aim to sweep away user hesitation when meeting up with a person they meet online.

with works with a very popular mentalist in Japan who is an effective influencer and practical supervisor of the matching process. Matches are based on personality tests to enhance compatibility, all of which attract more female users.

Since Japanese people are not traditionally receptive to the concept of online dating and tend to be shy about going on a date, these features attract users by addressing important cultural factors. The online dating industry shows that in order to be successful in Japan, localization and understanding your target users is key to attracting users.

#####

Are you struggling while trying to enter the Japanese market? We are Japanese market entry specialists based in San Francisco and Tokyo and are here to help you. Check out our services in market research, localization, and marketing and contact us today! We look forward to hearing from you.

Enjoy this article? Subscribe to our newsletter to receive updates on our latest articles, news in Japan, and more!