Btrax Design Company > Freshtrax > Japanese Hold A...

Japanese Hold As Many Credit Cards As Americans, But Do They Use Them?

In Japanese society, there are more opportunities to receive a credit card than most other societies. If you live in Japan, you will be surprised by how often you are recommended to create a new credit card when making purchases at stores. They will offer you benefits such as getting extra discounts; earning points like miles, and receiving special services with the requirement of making a new card. Some thrift shoppers use several credit cards at different stores and occasions.

Getting approval for a credit card in Japan is not very difficult. Many students apply for credit cards and are quickly approved. As long as they are over 18 years old and have some amount of regular income, typically equalling to 10 hours of part-time work.

You may have heard that Japanese people use cash rather than credit or debit cards. While that may be true, Japanese actually have as many credit cards as Americans do. Research shows that there are 258 million credit cards currently issued in Japan. This means that every Japanese adult has approximately 2.5 credit cards, which is very close to how many Americans have per person (2.6 credit cards).

Even though Japanese have a high number of credit cards, they make use of their cards for only 17% of their purchasing activities. One study shows that 40% of Japanese want to use credit cards more. Why do Japanese hold more credit cards than necessary and still not use them?

In Japan, the Bar To Own a Credit Card is Quite Low, But Why Don’t Japanese Use Them?

The main reasons that Japanese choose to pay by cash instead of credit cards can be described by these 3 mentalities:

Credit Cards Don’t Make My Life More Convenient!

According to research by the Japanese government, 58% of Japanese answered that they use credit cards reluctantly. There are still many occasions in which the only type of payment accepted is cash. On top of that, Japan is considered a safe country with pickpocketing not being a big problem. Therefore, people do not hesitate to carry cash.

Nevertheless, in terms of security when people lose their wallet, they should be aware of the benefit of carrying a credit card. Since there are accounts for credit cards, the value of the amount that people have access to still remains. On the contrary, if cash gets lost or stolen, the value cannot be restored. For this reason, those who use cash more often than credit cards may be taking an unnecessary risk in carrying around so much money.

Credit Cards = Debt = Should be Avoided

Since use of a credit card means you potentially going into debt, some Japanese do not support credit card usage. Others are concerned about spending more money than they make. The potential pitfalls of a credit card scare people enough that they won’t use a credit card, even with the various benefits it can provide such as points and convenience.

Fear Of Fraud

Japanese people’s fear of fraud keeps credit card usage from being the main channel of payment when making purchases. Many of them are afraid of credit card scams and are hesitant to use them unless they are required to. Credit card online usage especially makes some Japanese people uncomfortable as they don’t like giving their card information to a website.

One interesting example that showed how Japanese avoid making transactions with credit cards was consumer habits when Apple’s iTunes launched in Japan. Japanese people bought iTunes gift cards for their own use to avoid using credit cards online.

Another example is when making an online purchase in Japan, Japanese will choose to make a purchase by directly paying a delivery person when a package arrives or choose to pick it up at a convenience store like 7-11 and pay with cash.

Why Does All This Matter?

When planning to expand a business to another country, the first step people usually take is to research the market by looking up numerical data. Quantitative data has a lot of valuable information to understand the community to expand to, but in many cases, that is not enough.

If you own an e-commerce company which plans to expand your business to Japan, one thing you’ll want to know is how they make online payments. From initial research, you would see data that Japanese hold as many credit cards as Americans.

Knowing this data gives you first layer insight but learning about the society’s cultural background would add to the analysis. If you know that people feel nervous when entering their credit card information online, you can make sure to offer more user friendly payment options.

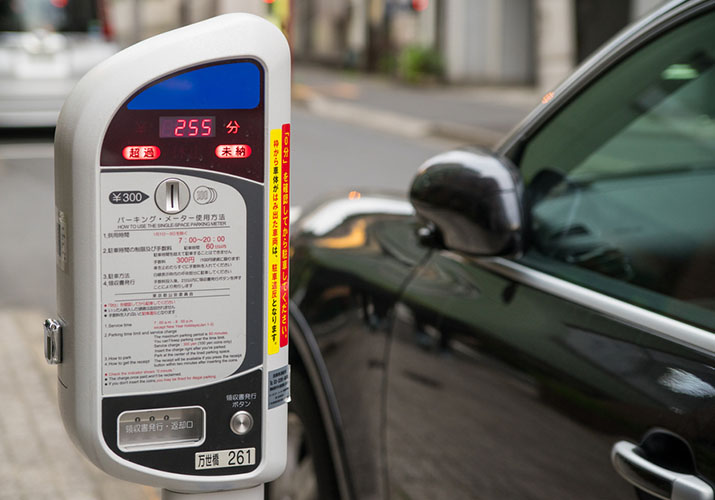

This parking meter does not accept credit card payment

Understanding consumer purchasing habits and flow are key to increasing sales when expanding into new markets. A little deeper understanding of your target market will help with your localization efforts and help you to not make some easy-to-avoid mistakes.

Interested to find out where the trend on credit card usage is heading to? Are more Japanese starting to use credit cards? Check out our article covering the status of e-commerce in Japan for more details in the payment system in the e-commerce business in Japan.