Btrax Design Company > Freshtrax > Charging it in ...

Charging it in China: Part II

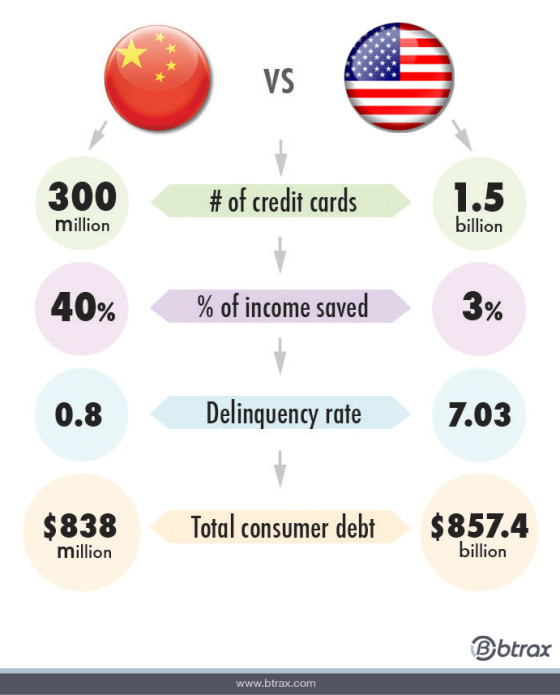

In Part I of Charging it in China, we explored the slow but steady rise of credit card use in China. Now it’s time to explore the history and psychology behind the population’s credit card usage habits, and how companies can encourage a culture more open to the practice.

Card Control

The Chinese credit card market is completely controlled by China Unionpay China, which is highly policy-driven and often controlled by political intervention. Government regulations can be a huge influence to the industry, and they often lean towards supporting domestic companies. Although collaborations are possible, this is just one challenge.

A History of Saving

Credit cards also haven’t earned their dues yet in China because the tradition of spending only what you earn overrides the basic concept of credit. With everyone paying their bills back on time, companies aren’t earning nearly as much interest as they have in America. On top of that, many stores hesitate to sign up for the service, seeing merchant fees as another unnecessary expense that deters customers from shopping.

Who’s Buying?

Still, credit cards have found a niche in China, and that niche will grow if companies destroy their preconceptions and understand Chinese consumers as individuals. If MasterCard can project that annual credit card spending in China will more than double by 2025, there must be some strong supporters in the country. Companies just need to know who’s doing the spending, and how. Almost all Millennials and foreigners own cards, but most of them are only used for big-ticket items and luxury brands at major department stores. However, even though cards are currently appealing to a certain core demographic, the culture of giving means that they are often purchasing goods and services for both their elders and their young ones.

The Sandwich Generation

The group of 20-30 years olds born during the one-child policy find themselves between their aging parents and young children. Often having to provide and care for both sides, the Sandwich Generation would benefit on relying more on credit in the future. Card companies that want a shot in this market should focus their efforts and speaking to this demographic and look for support from big brands and their merchants.

Another cultural factor boosting the use of credit use is the inherent “social power” of these cards, displaying the material wealth and Western willingness to take on debt–a surefire way to show a lifestyle of abundance and stress-free shopping. For some young, urban consumers, a luxury purse looks all the more alluring when it’s filled with flashy, custom-embossed cards. They’re like a fashion statement reflecting the personality of the owner. On top of that, they’re much cleaner to use than exchanging cash, which can carry the hepatitis B virus amongst other illnesses.

Cash Out

Along with a rapidly growing market for global goods and services, all these reasons and more will keep Chinese credit card growth on the up and up. On a personal note, companies that work with btrax have seen huge growth since online Chinese merchants have been able to accept credit cards through UnionPay, and this is just the beginning.

Photo source

Check Out Our FREE E-Books!

Discover our FREE e-books packed with valuable research and firsthand insights from industry experts!

Dive into our collection below, and stay tuned – we’re constantly adding new titles to keep you ahead of the curve.