Btrax Design Company > Freshtrax > Food Delivery S...

Food Delivery Service Market in Japan

Thanks to convenient food delivery services like Uber Eats, Grubhub, DoorDash, and Postmates, we can order food almost anywhere and anytime in the United States. Although the food delivery service market in Japan differs a bit from the United States, residents of major cities in Japan often use quick-and-easy food delivery services to enjoy meals, from lunch at noon to boba tea at midnight.

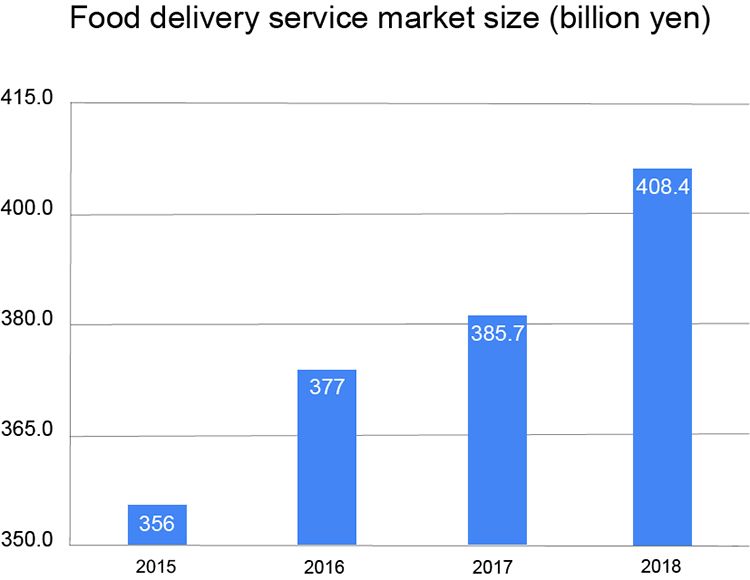

The market size of food delivery in Japan in 2018 was 408 billion yen (3.8 billion U.S. dollars), which increased by 5.9% from the previous year. The market has been growing with more and more service options, especially since Uber Eats expanded its business to Japan in September 2016.

One of the biggest reasons for the rise of the food delivery market in Japan is how difficult it has historically been for business people who have few restaurant options around their office to grab lunch. With few options around, restaurants would always be flooded with customers, making getting lunch from one of these restaurants a time-consuming and inefficient experience. These so-called “Lunch refugees” needed a faster way to get lunch and food delivery seemed to be a good solution.

Although the Japanese food delivery service market is still small compared to other countries such as the U.K., China, and Germany, there is still a lot of potential for new entrants in the food delivery market. Want to know what the Japan food delivery service market is like? In this article, I will introduce the landscape of the market, share insights on traditional Japanese food delivery services, and discuss two case studies, Demae-can and Uber Eats.

The food delivery landscape in Japan

Food delivery in Japan started over 300 years ago during the Edo period (1603-1867 A.D.) During this time, food like fresh fish, vegetables, and soba (Japanese noodles) were delivered.

As the market has grown over the years, the variety of foods introduced into the food delivery service market has increased. Some new additions include pizza, sushi, and Japanese curry. Before companies like Uber Eats entered the market, most orders were placed by phone call or through the restaurant’s website instead of through an app, allowing users to pay once the food was delivered to their house.

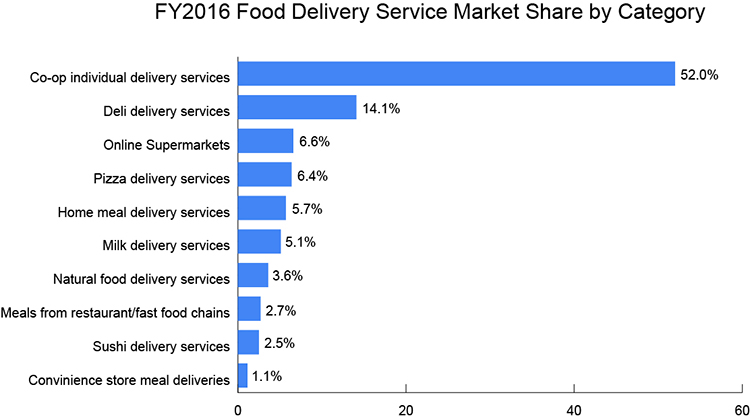

Japanese food delivery service market share

From ready-to-eat food to pre-cooked microwavable dinners and fresh vegetables, there are many types of food delivery services available in Japan. To understand the market better, we have categorized it into 3 segments:

1. Raw and fresh food delivery

In relation to the chart below, this category consists of “Natural food delivery services”, “Milk delivery services”, “Online Supermarkets”, and “Co-op individual delivery services”, which includes the delivery of meat, fish, vegetables, and other ingredients. Co-op is a type of online grocery shopping site where users can purchase almost anything supermarkets offer. There are also options to order food one week in advance and have it delivered directly to your house.

Food delivery services like Oisix (Oythix) and Pal System deliver their own original food and ingredients. Internet supermarkets, like Aeon Net Super, and general supermarkets offer services to deliver food to the customer’s house after they have purchased food at the shop. This service is helpful for the elderly who have a difficult time carrying their groceries home.

2. Processed and precooked food delivery

This category consists of “Home meal delivery services” and partially “Online Supermarkets”. These sell frozen or pre-packaged food, like instant noodle packages, that require some cooking or warming. There are many companies that deliver both processed and fresh food as the ordering and delivery systems are the same. The only difference is in what condition the food is in.

3. Ready-to-eat food delivery

From pizza delivery to catering, this category is made up of “Deli delivery services”, “Meals from restaurant/fast-food chains”, “Sushi delivery services”, and “Convenience store meal deliveries.” It includes food that is fully prepared and ready to consume.

Co-ops have a strong presence in the market

The “Co-op individual delivery services” share occupies more than 50% of the food delivery service market. This is because many Japanese households rely on this type of service. According to a survey conducted by the Japanese Consumers’ Co-operative Union (JCCU), 25% of the Japanese population use Co-op’s delivery service.

The “Deli-delivery services” category has the second largest share of the market with 14.1%. This category consists of services like Uber Eats and Demae-can (I will explain more about this later). Other notable services in the market include the individual delivery services from supermarkets or restaurants that deliver specific items like milk, natural food, and sushi.

How people in Japan use food delivery services

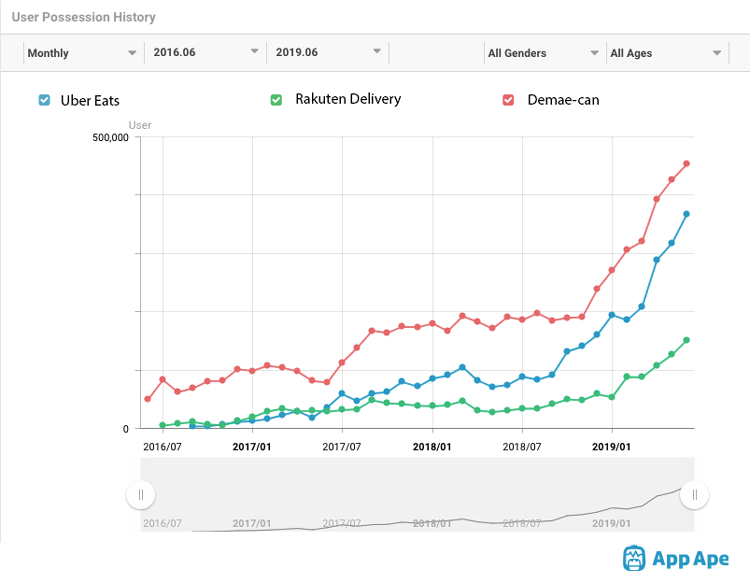

The chart below indicates the user growth of 3 major deli delivery apps: Uber Eats, Demae-can, and Rakuten Delivery. Along with the deli delivery apps listed in the chart, D-Delivery, GURUNAVI, and LINE Delima are the other key players making up this type of food delivery market share in Japan. With substantial growth in 2019, it seems the trend will continue to show these apps grabbing more of the market share.

Source: AppApe

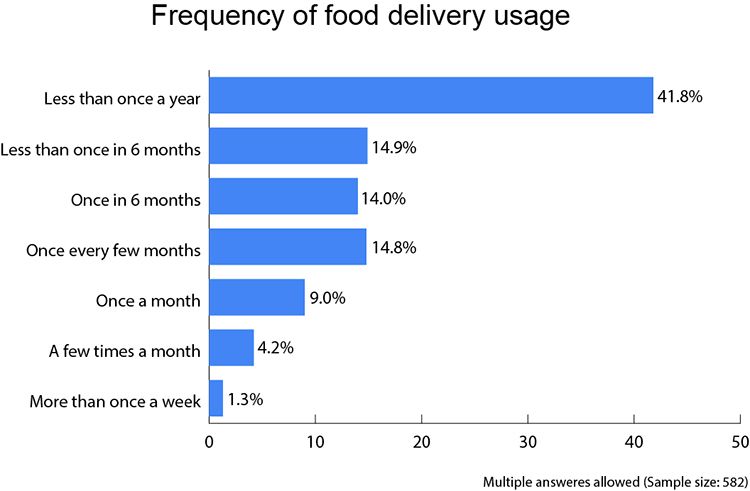

Frequency of using food delivery services

A survey shows that 58.2% of users in Japan use food delivery services at least once a year while 1.3% use it more than once a week. This shows that using food delivery services is not very common for most Japanese people yet.

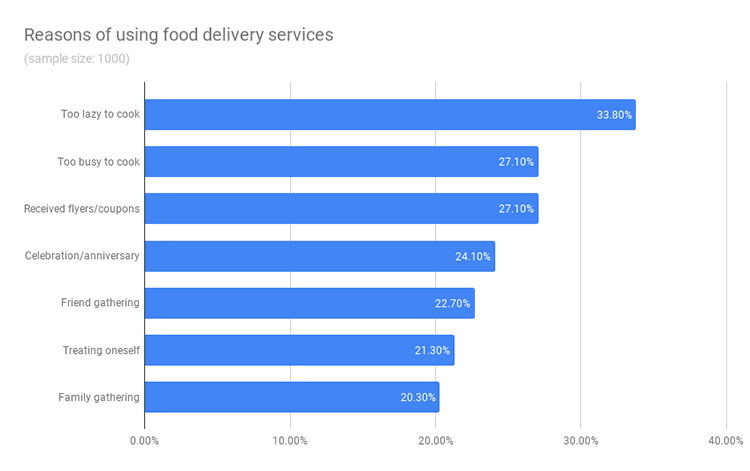

Motivations for using Japanese food delivery services

The three main reasons people in Japan use a food delivery service include:

1. They don’t want to or are too busy to cook

2. They have coupons or saw an advertisement for a food delivery service

3. It’s for a special occasion, like parties with friends or relatives

Oftentimes, the Japanese tend to use coupons because restaurants and food delivery companies give away coupons via mobile apps or newspaper ads. For example, LINE, a messaging app used by more than 79 million users in Japan, has a service in which it offers coupons from over 22,000 different restaurants and food-related stores.

【Related article】The Ultimate Guide to Using LINE App for Business

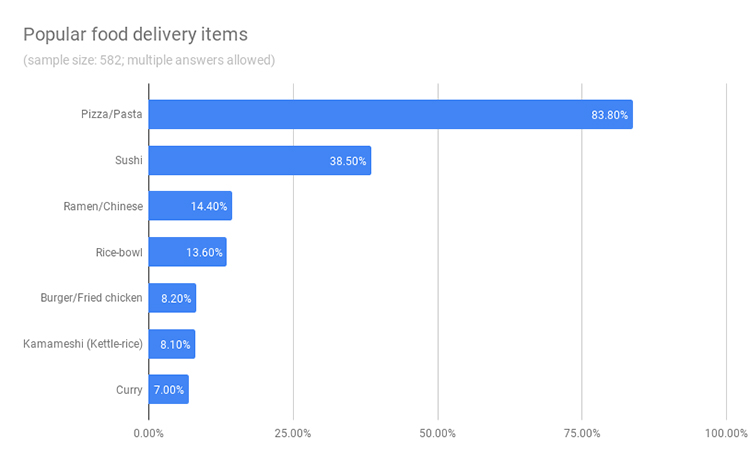

Most popular food delivery items

The graph above shows how people in Japan categorize popular delivery food items. Pizza delivery is popular because famous pizza delivery companies including Domino’s, Pizza-La, Pizza Hut, among others, have expanded their shops nationwide, even to the rural areas where new food delivery services apps are not yet available. Since pizza companies also offer a rich variety of pasta as well, pasta has become a popular food among Japanese when ordering delivery food.

Sushi is another popular delivery item. Historically is has been ordered for special occasions like family gatherings or anniversaries. However, the Japanese are ordering sushi more and more to enjoy when they’re at home as well because there are many affordable assortments and packages.

For the most part, you can enjoy a variety of foods via delivery services in Japan. Even Japanese noodle dishes like Ramen can be ordered, as it can be delivered without spillage, thanks to special delivery bikes depicted in the images below.

Challenges for Japanese food delivery services

Some Japanese people hesitate to use online delivery services

Japanese aren’t hesitant about making a call to order food, but some are hesitant about using online delivery services because they still think that online payment systems are not safe or too complicated.

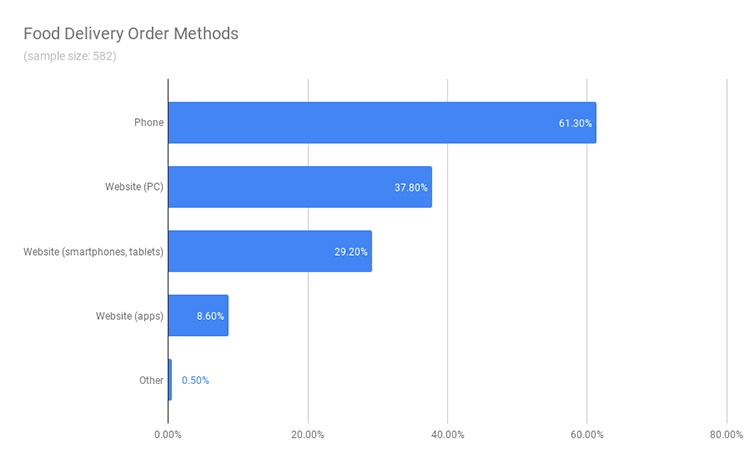

You can see from the chart above that 61.3% of all the people who use a food delivery service at least once a year will order by phone. That number is more than all the orders made through PC and smartphones/tablets combined.

As you can see in our previous article on mobile payments, one reason more deliveries are made by phone calls, as opposed to the other methods, is that 51% of the Japanese are against a cashless society. Also, since a third of the Japanese population is over 60 years old, the elderly feel overwhelmed and concerned by their lack of technical knowledge needed to operate new delivery apps and websites.

Convenience stores are the real competitor to food delivery services

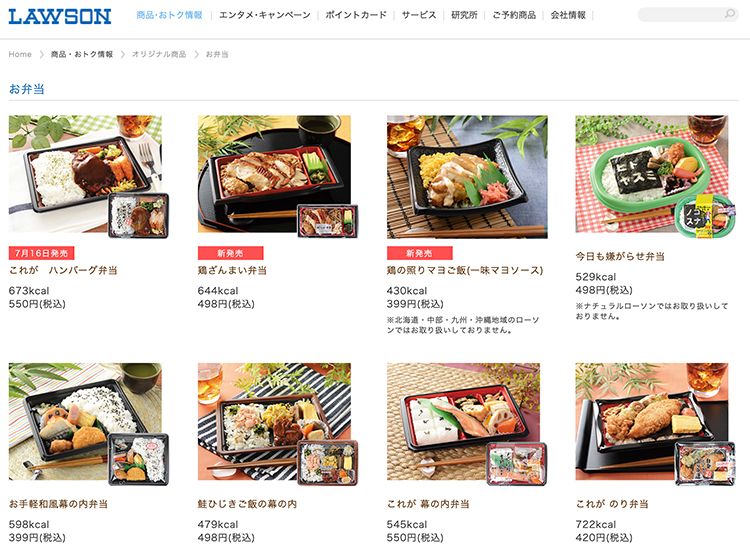

Why is the food delivery service market in Japan smaller compared to other countries? The difference between Japan and other countries is that it’s easy to get high-quality food at convenience stores. Many of the convenience stores are open 24-7 such as 7-Eleven, Family Mart, and LAWSON and they offer various kinds of high-quality food at a fraction of the price at restaurants.

A survey showed that there are 55,000 convenience stores in Japan. Since Japan is a small country, you can find convenience stores pretty anywhere in the country. In big cities like Tokyo, it is especially easy to find a convenience store as they are all over.

Another reason the food delivery service market is still fairly small is that most online food delivery services are not yet available in rural areas. Fortunately for those who live in these rural areas, convenience stores exist almost everywhere. Convenience stores seem to be the real competitor to food delivery services because they’re easy to get to, offer a wide variety of foods, and are inexpensive.

LAWSON’s website shows a variety of foods available anytime. (Source)

Case studies: How to improve your food delivery service in Japan

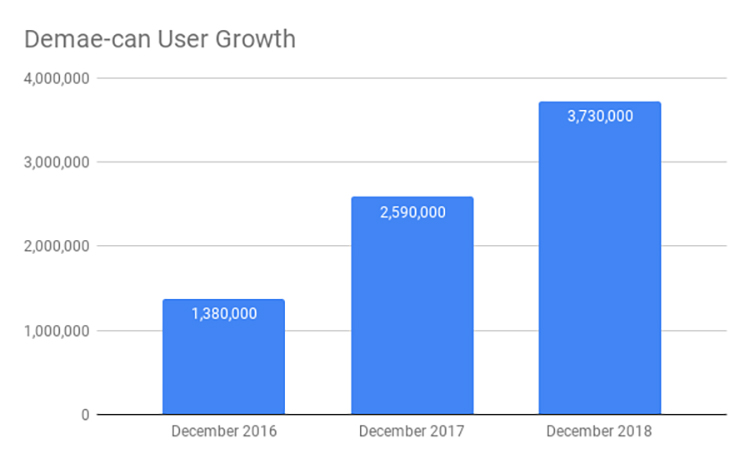

Demae-can: Find the right partner

Originally, Demae-can was a delivery service website that solely acted as the middleman between restaurants and customers. However, its service model only included restaurants with delivery service capabilities. On top of paying for Demae-can’s services, restaurants still needed to find their own delivery person.

Demae-can’s delivery motorbikes in front of Asahi Shimbun. (Source: 夢の街創造委員会)

To solve those problems and improve its service, Demae-can started a new service called “シェアデリ” (share-deli) which means “delivery share” in Japanese. The service outsourced delivery people to restaurants. This allowed Demae-can to expand it’s service to restaurants that did not have their own delivery services along with the restaurants it was already partnered with at the time. This allowed Demae-can to provide a larger variety of food options to more customers.

To bring its delivery service to life, Demae-can signed a partnership with Asahi Shimbun, one of the most popular newspapers in Japan. The plan was to use the newspaper company’s motorbikes to deliver food when the company was not using them. It worked out because the bikes were only being used in the morning and for a few hours in the evening.

Demae-can efficiently used Asahi Shimbun’s bikes to expand its business with Asahi Shimbun hiring part-time workers for the Demae-can delivery service, allowing food to be delivered at any time. The service started in 2016 and continues to increase in sales.

Demae-can users have increased every year (Source)

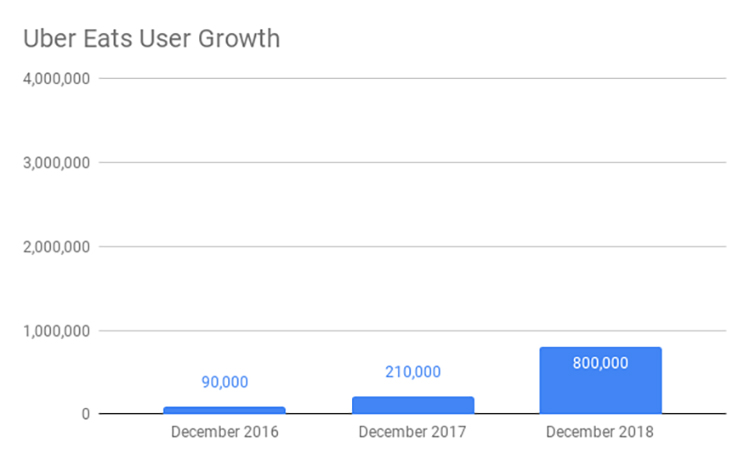

Uber Eats: Adapt to Japanese customs and participate in social events

Uber Eats is successful in Japan because it understands Japanese consumer behaviors and traditional customs.

Uber Eats shows an increase in users each year (Source)

Save the “lunch refugees”

Before the service launched in Tokyo in 2016, there were not many on-demand food delivery services like it in Japan. Uber Eats hosted a huge promotional campaign in which users only paid 500 yen ($5 U.S. dollars) for every meal ordered through the app. The promotion encouraged many business people to use the Uber Eats app.

Assimilate to the culture: Hanami

Hanami, means “flower viewing,” and is one of the most popular times of the year. During this time, many people go on picnics in areas where cherry blossoms are. Thousands of people go to parks to see the blossoming flowers along with enjoying food and drinks with friends and family. Sometimes these parties go on until late at night.

Uber Japan started a campaign called the “Empty-handed Hanami” campaign. The campaign encouraged people to use Uber Eats for Hanami, suggesting that picnickers use Uber Eats so that they don’t need to bring anything but themselves to the parties. Many coupons were passed out in crowded places to promote the campaign.

Celebrate the new Imperial era

When the cherry blossoms fell and the Hanami season ended, Uber started the “Hello Reiwa” campaign in 2019. Reiwa is Japan’s new Imperial era name, used on documents, newspapers, and coins in Japan. All of Japan was excited about the special occasion, in which a new Emperor succeeds the previous one.

The campaign gave 10,000 yen (100 U.S. dollars) gift codes to 10 lucky users who followed Uber Eats’ Instagram and Twitter accounts and liked its promotion post.

Uber Eats was able to increase its customer base because it thoughtfully displayed its interest in incorporating Japanese customs by creating promotional campaigns that were relevant to special life experiences in Japan.

Conclusion

The Japanese food delivery market continues to get bigger and bigger. Why? Because more and more food services are finding the right partners, like Demae-can, or changing their business strategies to understand and connect to Japanese cultural events, like Uber Eats.

However, there are still concerns when entering the Japanese food delivery market because a large number of people are not comfortable using online services, online payment platforms, or food delivery apps in Japan. Also, with convenience stores everywhere, there is bound to be heavy competition.

Get to deeply know the culture, how the market works, and how people may react to new services and new technologies. It will take time to research all this on your own, but it is worth learning. When thinking about your business model and value proposition, make sure to remember that Japanese, especially the older generation, take security and ease of use seriously when trying out a new service or app. As long as you keep these tips and notes in mind, you can help the Japanese can enjoy a wide variety of food with more service options.

#####

Over many years we have shared our knowledge of the Japanese culture, customers, and business structure, helping many global brands expand their businesses to Japan. Contact us if you need help determining your value proposition in Japan! If you like our content, sign up for our newsletter and follow us on Twitter and LinkedIn. We look forward to connecting with you!

Edit by: Julie Saephan