Btrax Design Company > Freshtrax > The Rise of Chi...

The Rise of Chinese Brands

This past December I was invited to give a talk to over 2000 attendees at Alibaba’s annual E-Commerce Marketing Summit in Hangzhou, China. My presentation was on why Chinese companies should pay attention to lifestyle branding, not only to compete globally, but also as a way to avoid the China market’s race to the bottom in pricing.

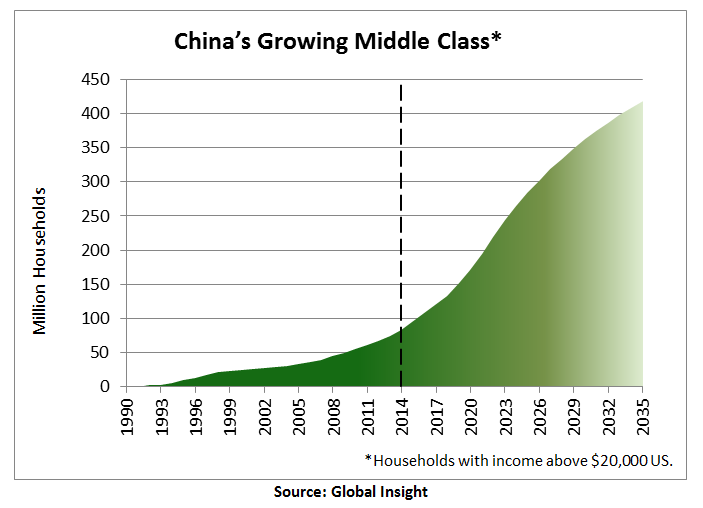

This article will outline how changes in China’s demographics and lifestyle habits are impacting both Chinese and foreign companies operating in China and beyond. In particular, the West remains largely unaware of just how big the Chinese middle class has become – and the degree to which large-scale shifts in their consumer habits have the potential to transform Chinese brands into global brands.

Convergence in the Global Middle Class

In 2015 the U.S. middle class dropped below 50% of the population for the first time in three generations. At the same time the middle class outside of the US is exploding. In particular China’s middle class has reached 109 million people in 2015, surpassing the 92 million in America.

The US and global markets are clearly on converging paths, but what does it mean for brands?

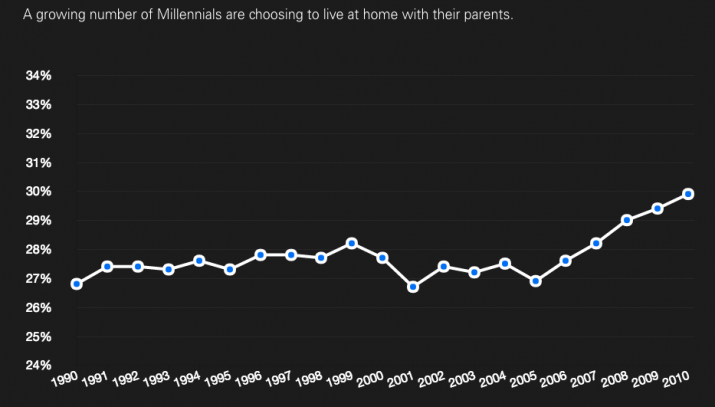

Americans still care about lifestyle values when they buy, but are becoming more cost conscious, especially among millennials who are making less relative to the cost of living than the previous generation. Over 30% of millennial live with their parents – a trend that has been increasing for a decade. So there is something to learn from Chinese brands that have succeeded.

Compared to 10 years ago, the China market is no longer dominated by a large number of people who want the cheapest price and an elite group who snap up luxury goods.Things have become more complex.

Chinese consumers have matured and so have their pocketbooks. They want to buy things that resonate with their lifestyle and personal beliefs. What has been happening in Hong Kong for a while is spreading to the mainland.

Looking forward this trend will only accelerate, powered by the generation born after the mid-1980s and raised in a period of relative abundance. A generation that is three times larger than the baby-boomer generation that drove the U.S.’s prosperity.

Cultural Cross-Pollination & Evolving Markets

A superficial glance can make it seem global brands are selling the same product everywhere with just packaging modifications. But when you dig beneath the surface, more products are being localized in deeper ways or even created from scratch to connect with local cultures and markets.

Apple released red and gold watches. Campbell’s tweaked their soup recipes and ditched their iconic cans for collapsible pouches. Hollywood studios added scenes or even changed the endings of their films.

Viktoria Roy / Shutterstock.com

In a truly disruptive fashion, Chinese companies have gained footholds in the commodities end of the spectrum, but are looking to move up. Chinese brands are growing market shares in diverse places with Xiaomi phones in Brazilian hands and Haier fridges in American university dorms. It’s not a stretch that American students’ first home purchases after graduation might include a brand they have already used and trust.

However Chinese companies price advantage is steadily eroding as labor costs increase in China and consumer attitudes make on-shoring for Western companies attractive again. Most importantly, the lowest price doesn’t always win, especially for non-commodity items in mature markets outside of China.

Chinese Brands’ Weaknesses

Chinese brands still face some hefty barriers to successfully competing overseas. There are two particular hurdles they have to clear:

1) Overcoming Brand China

Westerners still see Chinese products as being cheap, low quality knockoffs. The benchmark will be high for them – in some ways they will need to be better than their Western peers, who are not burdened by this image problem. They will need to make their brand distinct and invest heavily in attracting and keeping local audiences.

2) Transitioning from Price to Lifestyle Value

For companies who are organized around cost cutting and efficiencies, this is a tough shift involving a wholesale rethinking of process and culture from the C-level down.

Some maverick Chinese business leaders who have put younger, more internationally savvy employees and foreigners with long brand experience into decision-making roles are making the most headway.

China’s top sports apparel brand Li-Ning is a cautionary tale of a company trying to copy their brand competitors (headquartering in the same Oregon city as Nike) and adopting only the trappings of lifestyle branding (not finding a niche subculture and dominating).

Chinese Brands’ Advantages

But Chinese brands do have several valuable strengths over their foreign counterparts:

1) Mobile first orientation

Chinese brands have made their mark by focusing on making the mobile space first, since most of their customers don’t have computers at home. In some ways foreign brands are catching up, since they have had to serve two masters: older customers using desktop computers and younger audiences using mobile devices as their primary or only Internet access point.

2) Messaging platform strategy

Brands in the US are still exploring exactly how to leverage messaging platforms that have recently become hugely popular, including SnapChat, WhatsApp and WeChat. The big player in Chinese social media has been Weixin (WeChat) for a longer time, since Facebook and Twitter are blocked in China and Sina Weibo (often called China’s Twitter) has lost momentum.

Weixin is a mutli-faceted and ecommerce-oriented platform, providing them hands-on experience in the kind of online ecosystems that are likely to evolve in the US in the next few years. Having operated and experimented in a market with one dominant messaging platform along with many niche ones has built up Chinese brands’ dexterity.

3) Experience winning in diverse markets

Unlike many Japanese or other brands which come from homogenous domestic environments and struggle with highly fragmented markets such as the US, China is more regionally diverse and has to appeal a wider spectrum of people.

4) Nimble

Because of the fiercely competitive environment of China, even big companies have to move rapdily and decisively in creating value to retain market share. One of the common comments of business visitors to China is that their speed is incredibly fast, even by startup standards.

The Education of Chinese Brands

Chinese companies have been watching overseas brands, learning and expanding their sophistication as they mature in their own market. Some of these companies have particularly sharp business models and are reaching the limits of domestic growth. And they’re hungry.

Western brands will soon find themselves competing with Chinese companies, much as Japanese emerged in the 1970s and 1980s, evolving from cheap consumer manufacturers into true domestic and global brands.

Also like Japan, the “soft power” of fashion and entertainment is likely to follow on the heels of success in the consumer electronics space. This is already happening: Tencent owns most of Riot Games and Wanda’s purchase of AMC’s chain theaters and the major Hollywood film studio Legendary Entertainment.

A decade of education and increased flow of people in and out of China is now reaching critical mass. China’s business leaders doesn’t just want to consume our brands or manufacture them, they want to create and own them too.

Featured image: livcool/Shutterstock

Check Out Our FREE E-Books!

Discover our FREE e-books packed with valuable research and firsthand insights from industry experts!

Dive into our collection below, and stay tuned – we’re constantly adding new titles to keep you ahead of the curve.

- Big in Japan: Global Brands Thriving in the Japanese Market, Vol. 1

- A Guide to the Promotional Seasons in Japan

- What I Wish I Knew Before Entering the Japanese Market

- 100+ Facts to Understand the Motivations Behind Japanese Behaviors

- Insights on Japan’s Changing Workstyle

- Insights into Japan’s E-Commerce and Direct to Consumer (D2C) Market