Btrax Design Company > Freshtrax > Cashless Trends...

Cashless Trends in Japan: Learn Why People Are Using Less Cash

Japan has historically been known as a cash-based society. But in the last few years, there has been an uptick in the usage of credit cards as the Japanese get more comfortable with the idea of cashless payment methods and COVID-19 sped up a shift to purchasing products online.

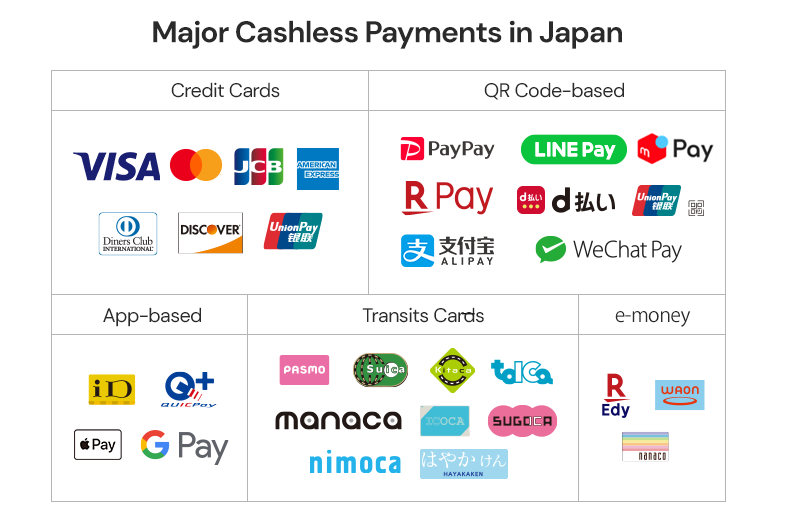

Three main occasions to use cashless payments in Japan

When we say “cashless” in Japan, there are three times consumers would typically use cashless technologies instead of cash. And depending on the occasion, the type of payment is different.

- Physical Stores: Credit Cards, NFC cards (Suica, Pasmo, etc), Payment Apps, QR Codes, e-money

- Online Stores: Credit Cards

- Train Stations: NFC, NFC Apps

Is cash still the main method of payment in Japan?

In recent years, cashless payments have been promoted in Japan, with the Japanese government planning to double cashless transactions to account for 40% of consumption by 2025. But I think there are still many people who mainly use cash, with many people having security concerns with using cashless technologies.

That being said more and more people are choosing to use cashless payment technologies due to benefits such as point accumulation and ease of use.

As we look at Japanese society today, we dive deeper to answer the question, “Do people in Japan mainly use cashless or cash?”

To find that out, we gathered research from multiple sources such as NaviNavi-Hoken and Dentsu.

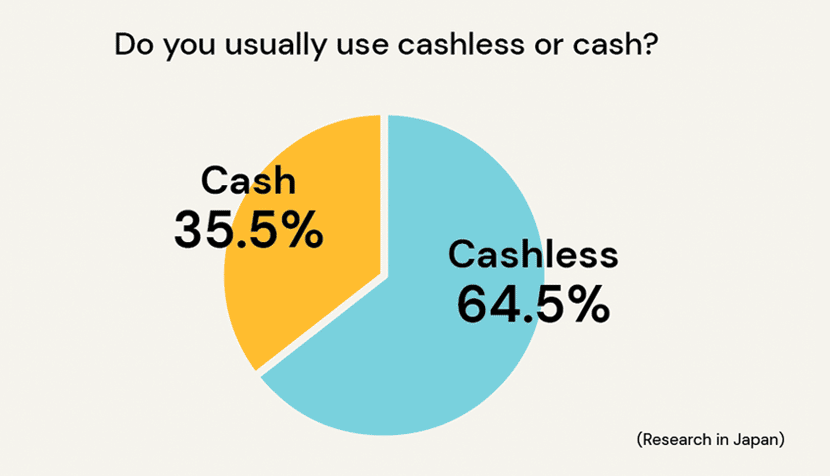

Japanese Consumer Survey

The first research was conducted with 560 people in Japan ranging between 20-79 years of age. Survey questions included, “When you go shopping, do you mainly use cashless or cash?” and “Why do you use that method?”

The results were broken down into different types of cashless payments, cashless usage by age groups, and reasons for their preferred payment method.

(survey period: January 6 to 12, 2021, age between 20-70, n=560)

Some highlights from the research include:

- 64.5% of respondents said they mainly use cashless payment online and offline

- The majority of respondents use credit cards as their primary cashless payment method

- Only 25% of respondents plan to go mainly cashless in the future

- There are some surprising situations where cashless payments can be used

64.5% of Japanese consumers mainly use cashless payments

In response to the question, “Do you usually use cashless or cash when you shop? 64.5% of the respondents answered “cashless” and 35.5% answered “cash.”

They use cashless payments at train stations, online stores, and physical stores.

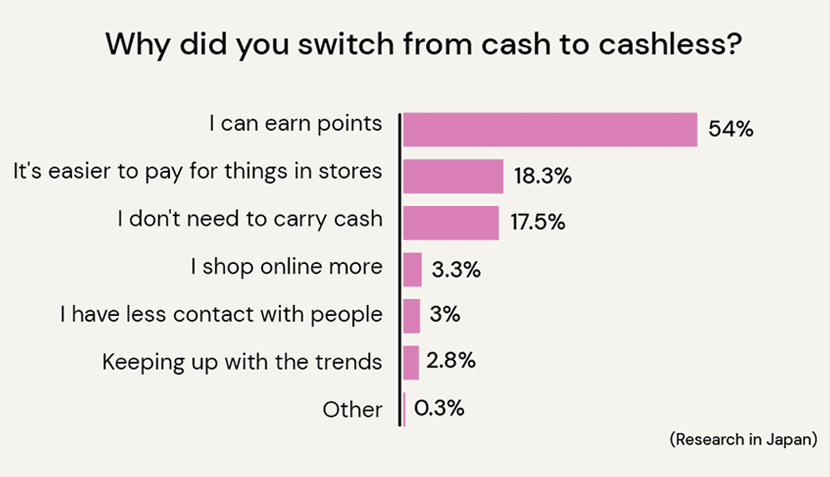

People use cashless to earn points, and because it is easier to pay bills

The most common reason given by those who mainly use cashless payments was that they can earn reward points.

The next most common answers were, “Not needing to carry cash” and “It’s easy to pay for things at stores”.

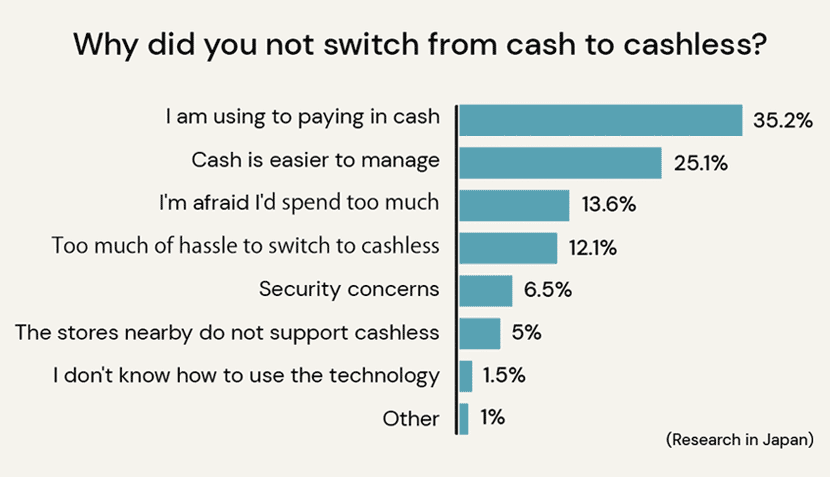

People use cash because they are used to cash, and they find it easier to manage

The most common reason given by those who mainly use cash was that they are used to using cash.

The next most common answers were, “Cash is easier to manage” and “It’s too much trouble to switch to cashless”.

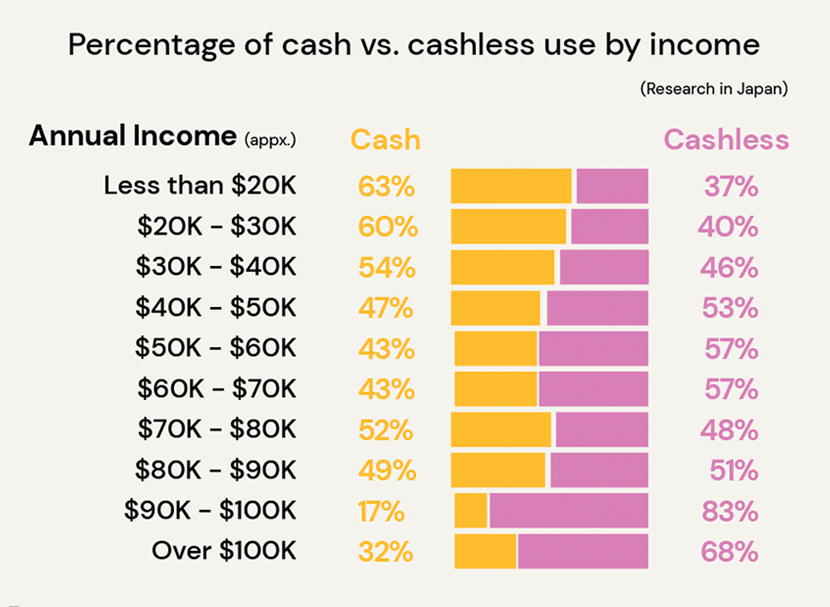

The higher the annual income, the less usage of cash

Next, we investigated the correlation between income and the use of cashless payment technologies.

The results showed that the higher the annual income, the more usage of cashless payments.

We believe that people with higher incomes are more likely to be financially literate and use cashless systems that earn reward points.

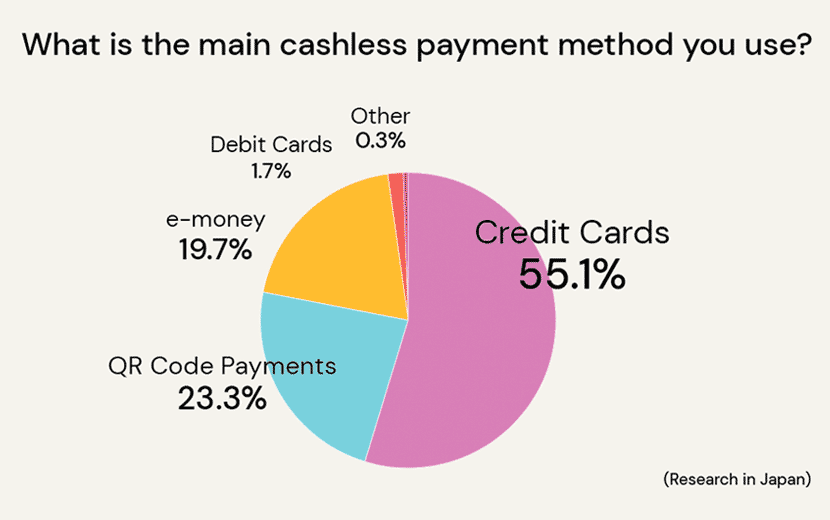

The majority of respondents use credit cards as their primary cashless payment method

When looking into the types of cashless payment methods people usually use, we learned that 55.1% of the respondents answered: “Credit card”, followed by “QR code” at 23.3%, and “Electronic money” at 19.7%.

Many people may not feel comfortable with app-based payments due to security concerns.

No bias by age among those who use cashless

This next statistic may surprise you as we usually think of the older generations to be less interested or open to new technologies.

We sorted the survey results by age and learned that there was no correlation between age and the adoption of cashless payment technologies.

We initially thought that younger people were more likely to use cashless, but it looks to be pretty evenly distributed, regardless of age.

It’s likely that the number of elderly people who stayed at home increased due to the pandemic with many of those people shifting to online shopping.

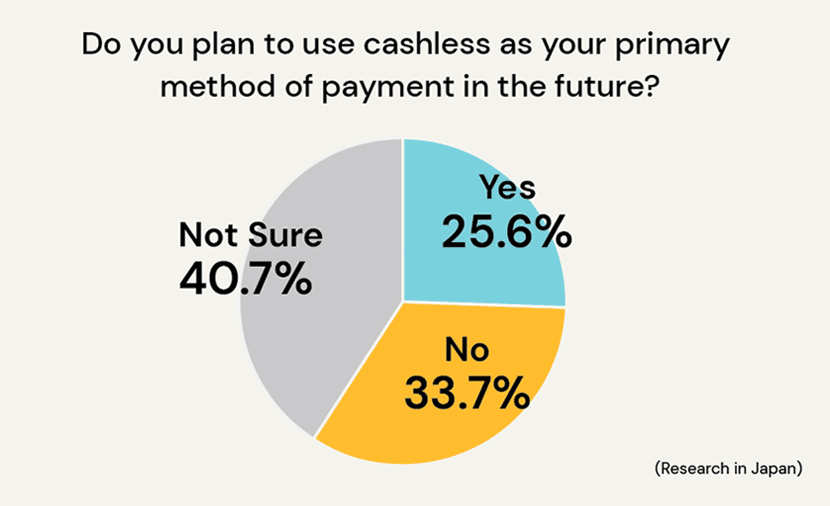

25% of respondents plan to go cashless in the future

We surveyed those who answered “I usually use cash” to find out if they would be switching to cashless in the future.

As a result, 74.4% of the respondents answered “don’t know” or “no”, and only 25.6% answered “yes”. Here are some reasons why people would or would not be switching to cashless payment methods:

Reasons to switch to cashless

- Because there are campaign deals

- Because it is troublesome to take out a 10,000 yen bill when paying a small amount when I only have a 10,000 yen bill on me. (10,000 yen = $100 USD)

- Because it seems to be an easy way to pay.

- Because it is hygienically safe

- Because I want to use it when I don’t have cash

- Because it is easy to pay without dealing with change

- Because it’s faster to pay

- Because we live in such an age

- Because I’m likely to buy more things online

- Because there are rewards

- Because there are more stores that support cashless

Reasons NOT to switch to cashless

- I am concerned about the security and management of cashless transactions

- Cashless increases debt

- Because it is easier to keep records

- Cash is easier to understand visually

- Because I might overspend

- Because I’m used to using cash

- I am used to a Cash-based lifestyle

- Cash is less complicated

- I don’t know which service to use

- Because I only trust cash

Reasons for “not sure”

- If it is easy enough to use, I will use it

- There are some cards that do not support cashless, so I would use them if more cards supported cashless

- Because there are few places where I can use it

- I think it would be better to use cash during times where cashless may not be convenient, such as if there’s a disaster or power outage

- I might use it if I need it

- Registration is troublesome, but if it is convenient, I would like to use it

- I don’t think it’s that widespread yet, so if it becomes more widespread, cashless may become the main choice

- I would like to use it if the security is solid, but I don’t think that is the case now

The main concerns are security and overspending

People who mainly use cash are mainly concerned with security and overspending when it comes to cashless. As a matter of fact, in Japan, cashless security issues have been in the news.

Some people are a little uncomfortable with the idea of linking an app to their bank account.

Cashless payment methods are becoming more accepted at stores in Japan

Another factor for people using cash is that there are only a few stores that support cashless payment methods. Recently the number of places that accept cashless payments has been increasing, and cashless can be used in more and more places across Japan.

While you are able to use cashless payment methods in chain stores and restaurants, smaller local establishments may still only accept cash.

Here are some examples of where cashless payments are now accepted:

Examples of services in Japan where you can pay with cashless payments

- Utility bills

- National tax

- Life insurance premiums

- Hospitals

- Social Security premiums

- House rent

The effect of COVID-19

COVID-19 has clearly shifted people’s purchasing habits in Japan with many not only shopping online for consumer goods but also increasing usage of food delivery services.

This change in people’s lifestyles has sped up usage and comfortability with cashless payment methods.

The below survey results show that cashless technology awareness is higher compared to before COVID-19, thanks to the benefits of point rewards, various discounts, convenience, and efficiency, along with the growing awareness of social distancing.

(survey period: December 6 to 12, 2020. age between 20-69, n=500)

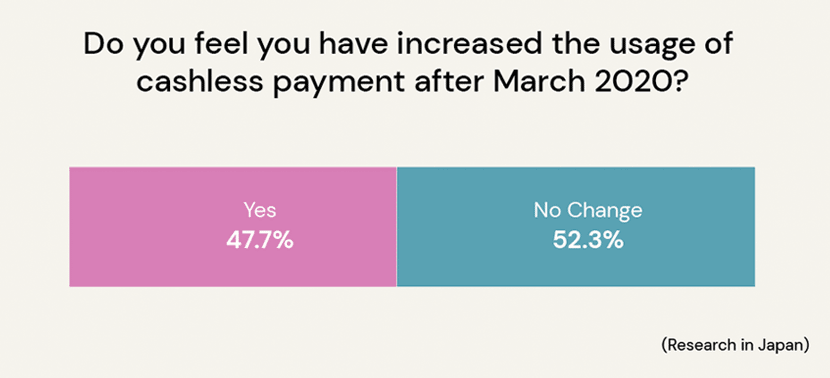

About 50% of consumers increased the use of cashless payments during COVID-19

About 50% of respondents said that the ratio of cashless payments to the usage of cash when buying products and services has increased since the emergency declaration in March 2020.

The breakdown of the people who answered “Yes” is:

- 17.2% of respondents had used mostly cashless before the pandemic, and the cashless ratio increased even more.

- 12.9% of the respondents had used cash slightly more before the pandemic, but the cashless ratio has increased.

- 11.2% of the respondents had used cashless slightly more before the pandemic, and the cashless ratio has increased.

- 6% of the respondents had used to only use cash before the pandemic, but the percentage of cashless payments has increased.

It will be interesting to see what happens with consumer purchasing habits post COVID-19. Two main reasons for switching to cashless are 1. More stores support it, and 2. Because they are contactless.

Social distancing contributes to the increase of cashless payments

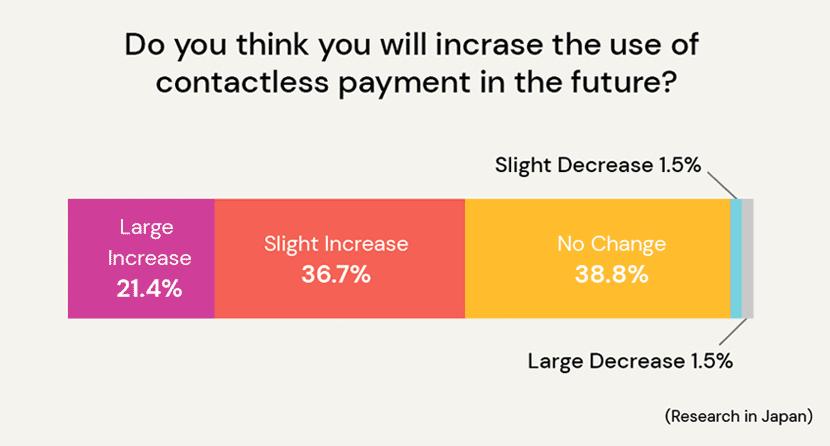

About 60% of the respondents answered that they think they will increase the use of contactless payments in the future. Growing awareness and the need for social distancing is one of the main reasons.

Cashless payments will be the next big thing in Japan

The data clearly shows that Japan is shifting rapidly from its traditional cash culture to a cashless one due to the pandemic.

As more stores move to support cashless payment technologies, consumers will increasingly use cashless payment methods benefiting from the speed and convenience they offer.

Another big reason people will go cashless will be the benefit of contactless payment terminals as people continue to social distance.